Form Wv/eft-5 - Electronic Funds Transfer Application - West Virginia State Tax Department

ADVERTISEMENT

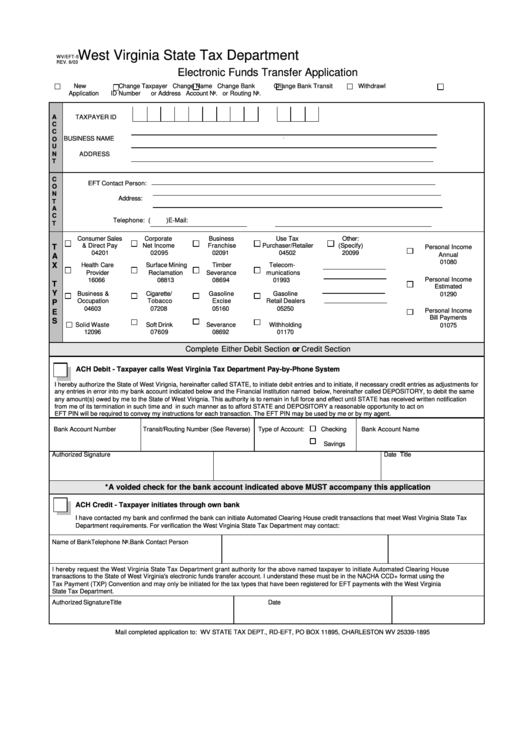

West Virginia State Tax Department

WV/EFT-5

REV. 6/03

Electronic Funds Transfer Application

New

Change Taxpayer

Change Name

Change Bank

Change Bank Transit

Withdrawl

Application

ID Number

or Address

Account No.

or Routing No.

A

TAXPAYER ID

C

C

BUSINESS NAME

O

U

N

ADDRESS

T

C

EFT Contact Person:

O

N

Address:

T

A

C

Telephone: (

)

E-Mail:

T

Consumer Sales

Corporate

Business

Use Tax

Other:

& Direct Pay

Net Income

Franchise

Purchaser/Retailer

(Specify)

T

Personal Income

04201

02095

02091

04502

20099

Annual

A

01080

X

Health Care

Surface Mining

Timber

Telecom-

Provider

Reclamation

Severance

munications

Personal Income

16066

08813

08694

01993

T

Estimated

Y

Business &

Cigarette/

Gasoline

Gasoline

01290

Occupation

Tobacco

Excise

Retail Dealers

P

04603

07208

05160

05250

Personal Income

E

Bill Payments

S

Solid Waste

Soft Drink

Severance

Withholding

01075

12096

07609

08692

01170

Complete Either Debit Section or Credit Section

ACH Debit - Taxpayer calls West Virginia Tax Department Pay-by-Phone System

I hereby authorize the State of West Virignia, hereinafter called STATE, to initiate debit entries and to initiate, if necessary credit entries as adjustments for

any entries in error into my bank account indicated below and the Financial Institution named below, hereinafter called DEPOSITORY, to debit the same

any amount(s) owed by me to the State of West Virignia. This authority is to remain in full force and effect until STATE has received written notification

from me of its termination in such time and in such manner as to afford STATE and DEPOSITORY a reasonable opportunity to act on it.The use of an

EFT PIN will be required to convey my instructions for each transaction. The EFT PIN may be used by me or by my agent.

Bank Account Number

Transit/Routing Number (See Reverse)

Type of Account:

Checking

Bank Account Name

Savings

Authorized Signature

Title

Date

*A voided check for the bank account indicated above MUST accompany this application

ACH Credit - Taxpayer initiates through own bank

I have contacted my bank and confirmed the bank can initiate Automated Clearing House credit transactions that meet West Virginia State Tax

Department requirements. For verification the West Virginia State Tax Department may contact:

Name of Bank

Bank Contact Person

Telephone No.

I hereby request the West Virginia State Tax Department grant authority for the above named taxpayer to initiate Automated Clearing House

transactions to the State of West Virginia's electronic funds transfer account. I understand these must be in the NACHA CCD+ format using the

Tax Payment (TXP) Convention and may only be initiated for the tax types that have been registered for EFT payments with the West Virginia

State Tax Department.

Authorized Signature

Title

Date

Mail completed application to: WV STATE TAX DEPT., RD-EFT, PO BOX 11895, CHARLESTON WV 25339-1895

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2