Form 3311 - Declaration For Free Entry Of Returned American Products

ADVERTISEMENT

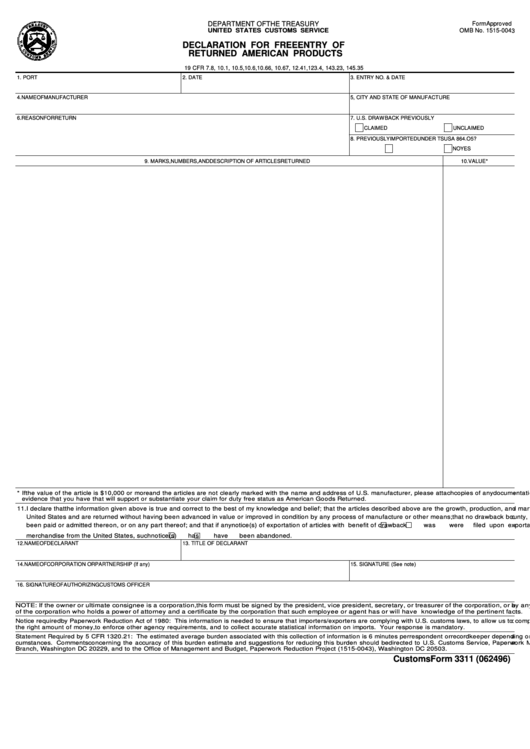

DEPARTMENT OF THE TREASURY

Form Approved

UNITED STATES CUSTOMS SERVICE

OMB No. 1515-0043

DECLARATION FOR FREE ENTRY OF

RETURNED AMERICAN PRODUCTS

19 CFR 7.8, 10.1, 10.5, 10.6, 10.66, 10.67, 12.41, 123.4, 143.23, 145.35

1. PORT

2. DATE

3. ENTRY NO. & DATE

4. NAME OF MANUFACTURER

5, CITY AND STATE OF MANUFACTURE

6. REASON FOR RETURN

7. U.S. DRAWBACK PREVIOUSLY

CLAIMED

UNCLAIMED

8. PREVIOUSLY IMPORTED UNDER TSUSA 864.O5?

YES

NO

9. MARKS, NUMBERS, AND DESCRIPTION OF ARTICLES RETURNED

10. VALUE*

* If the value of the article is $10,000 or more and the articles are not clearly marked with the name and address of U.S. manufacturer, please attach copies of any documentation or o

evidence that you have that will support or substantiate your claim for duty free status as American Goods Returned.

11. I declare that the information given above is true and correct to the best of my knowledge and belief; that the articles described above are the growth, production, and manufacture o

United States and are returned without having been advanced in value or improved in condition by any process of manufacture or other means; that no drawback bounty, or allowanc

been paid or admitted thereon, or on any part thereof; and that if any notice(s) of exportation of articles with benefit of drawback

was

were

filed upon exportation of the

merchandise from the United States, such notice(s)

has

have

been abandoned.

12. NAME OF DECLARANT

13. TITLE OF DECLARANT

14. NAME OF CORPORATION OR PARTNERSHIP (If any)

15. SIGNATURE (See note)

16. SIGNATURE OF AUTHORIZING CUSTOMS OFFICER

NOTE: If the owner or ultimate consignee is a corporation, this form must be signed by the president, vice president, secretary, or treasurer of the corporation, or by any employee or a

of the corporation who holds a power of attorney and a certificate by the corporation that such employee or agent has or will have knowledge of the pertinent facts.

Notice required by Paperwork Reduction Act of 1980: This information is needed to ensure that importers/exporters are complying with U.S. customs laws, to allow us to compute and co

the right amount of money, to enforce other agency requirements, and to collect accurate statistical information on imports. Your response is mandatory.

Statement Required by 5 CFR 1320.21: The estimated average burden associated with this collection of information is 6 minutes per respondent or recordkeeper depending on individua

cumstances. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be directed to U.S. Customs Service, Paperwork Managem

Branch, W ashington DC 20229, and to the Office of Management and Budget, Paperwork Reduction Project (1515-0043), Washington DC 20503.

Customs Form 3311 (062496)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1