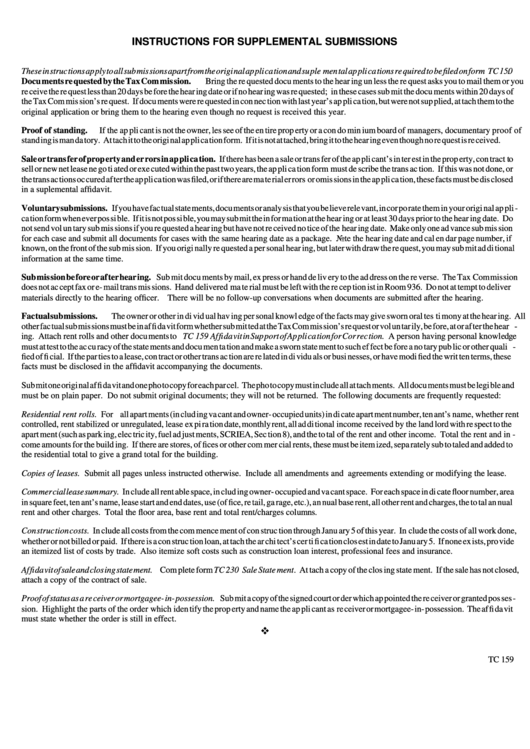

Instructions For Supplemental Submissions Form Tc 159

ADVERTISEMENT

IN STRUC TIONS FOR SUP PLE MEN TAL SUB MIS SIONS

These in struc tions ap ply to all sub mis sions apart from the origi nal ap pli ca tion and su ple men tal ap pli ca tions re quired to be filed on form TC 150.

Docu ments re quested by the Tax Com mis sion. Bring the re quested docu ments to the hear ing un less the re quest asks you to mail them or you

re ceive the re quest less than 20 days be fore the hear ing date or if no hear ing was re quested; in these cases sub mit the docu ments within 20 days of

the Tax Com mis sion’s re quest. If docu ments were re quested in con nec tion with last year’s ap pli ca tion, but were not sup plied, at tach them to the

origi nal ap pli ca tion or bring them to the hear ing even though no re quest is re ceived this year.

Proof of stand ing. If the ap pli cant is not the owner, les see of the en tire prop erty or a con do min ium board of man ag ers, docu men tary proof of

stand ing is man da tory. At tach it to the origi nal ap pli ca tion form. If it is not at tached, bring it to the hear ing even though no re quest is re ceived.

Sale or trans fer of prop erty and er rors in ap pli ca tion. If there has been a sale or trans fer of the ap pli cant’s in ter est in the prop erty, con tract to

sell or new net lease ne go ti ated or exe cuted within the past two years, the ap pli ca tion form must de scribe the trans ac tion. If this was not done, or

the trans ac tions oc cured af ter the ap pli ca tion was filed, or if there are ma te rial er rors or omis sions in the ap pli ca tion, these facts must be dis closed

in a su ple men tal af fi da vit.

Vol un tary sub mis sions. If you have fac tual state ments, docu ments or analy sis that you be lieve rele vant, in cor po rate them in your origi nal ap pli -

ca tion form when ever pos si ble. If it is not pos si ble, you may sub mit the in for ma tion at the hear ing or at least 30 days prior to the hear ing date. Do

not send vol un tary sub mis sions if you re quested a hear ing but have not re ceived no tice of the hear ing date. Make only one ad vance sub mis sion

for each case and sub mit all docu ments for cases with the same hear ing date as a pack age. Note the hear ing date and cal en dar page number, if

known, on the front of the sub mis sion. If you origi nally re quested a per sonal hear ing, but later with draw the re quest, you may sub mit ad di tional

in for ma tion at the same time.

Sub mis sion be fore or af ter hear ing. Sub mit docu ments by mail, ex press or hand de liv ery to the ad dress on the re verse. The Tax Com mis sion

does not ac cept fax or e- mail trans mis sions. Hand de liv ered ma te rial must be left with the re cep tion ist in Room 936. Do not at tempt to de liver

ma te ri als di rectly to the hear ing of fi cer. There will be no follow- up con ver sa tions when docu ments are sub mit ted af ter the hear ing.

Fac tual sub mis sions. The owner or other in di vid ual hav ing per sonal knowl edge of the facts may give sworn oral tes ti mony at the hear ing. All

other fac tual sub mis sions must be in af fi da vit form whether sub mit ted at the Tax Com mis sion’s re quest or vol un tar ily, be fore, at or af ter the hear -

ing. At tach rent rolls and other docu ments to TC 159 Af fi da vit in Sup port of Ap pli ca tion for Cor rec tion. A per son hav ing per sonal knowl edge

must at test to the ac cu racy of the state ments and docu men ta tion and make a sworn state ment to such ef fect be fore a no tary pub lic or other quali -

fied of fi cial. If the par ties to a lease, con tract or other trans ac tion are re lated in di vidu als or busi nesses, or have modi fied the writ ten terms, these

facts must be dis closed in the af fi da vit ac com pa ny ing the docu ments.

Sub mit one origi nal af fi da vit and one pho to copy for each par cel. The pho to copy must in clude all at tach ments. All docu ments must be legi ble and

must be on plain pa per. Do not sub mit origi nal docu ments; they will not be re turned. The fol low ing docu ments are fre quently re quested:

Resi den tial rent rolls. For all apart ments (in clud ing va cant and owner- occupied units) in di cate apart ment number, ten ant’s name, whether rent

con trolled, rent sta bi lized or un regu lated, lease ex pi ra tion date, monthly rent, all ad di tional in come re ceived by the land lord with re spect to the

apart ment (such as park ing, elec tric ity, fuel ad just ments, SCRIEA, Sec tion 8), and the to tal of the rent and other in come. To tal the rent and in -

come amounts for the build ing. If there are stores, of fices or other com mer cial rents, these must be item ized, sepa rately sub to taled and added to

the resi den tial to tal to give a grand to tal for the build ing.

Cop ies of leases. Sub mit all pages un less in structed oth er wise. In clude all amend ments and agree ments ex tend ing or modi fy ing the lease.

Com mer cial lease sum mary. In clude all rent able space, in clud ing owner- occupied and va cant space. For each space in di cate floor number, area

in square feet, ten ant’s name, lease start and end dates, use (of fice, re tail, ga rage, etc.), an nual base rent, all other rent and charges, the to tal an nual

rent and other charges. To tal the floor area, base rent and to tal rent/charges col umns.

Con struc tion costs. In clude all costs from the com mence ment of con struc tion through Janu ary 5 of this year. In clude the costs of all work done,

whether or not billed or paid. If there is a con struc tion loan, at tach the ar chi tect’s cer ti fi ca tion clos est in date to Janu ary 5. If none ex ists, pro vide

an item ized list of costs by trade. Also item ize soft costs such as con struc tion loan in ter est, pro fes sional fees and in sur ance.

Af fi da vit of sale and clos ing state ment. Com plete form TC 230 Sale State ment. At tach a copy of the clos ing state ment. If the sale has not closed,

at tach a copy of the con tract of sale.

Proof of status as a re ceiver or mortgagee- in- possession. Sub mit a copy of the signed court or der which ap pointed the re ceiver or granted pos ses -

sion. High light the parts of the or der which iden tify the prop erty and name the ap pli cant as re ceiver or mortgagee- in- possession. The af fi da vit

must state whether the or der is still in ef fect.

v

TC 159

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1