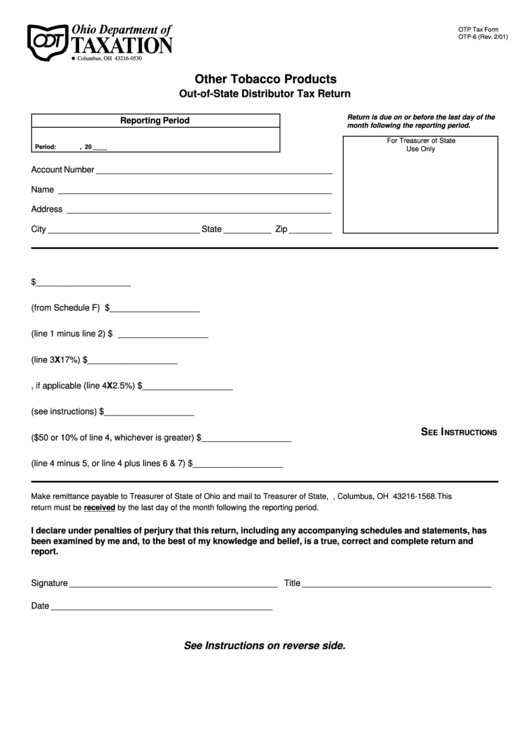

Form Otp-6 - Other Tobacco Products Out-Of-State Distributor Tax Return

ADVERTISEMENT

OTP Tax Form

OTP-6 (Rev. 2/01)

P.O. Box 530= Columbus, OH 43216-0530

Other Tobacco Products

Out-of-State Distributor Tax Return

Return is due on or before the last day of the

Reporting Period

month following the reporting period.

For Treasurer of State

Period:

, 20 ____

Use Only

Account Number __________________________________________________

Name __________________________________________________________

Address ________________________________________________________

City ________________________________ State __________ Zip _________

1. Wholesale Cost of Tobacco Products Sold ............................................................................. $ ____________________

2. Credits (from Schedule F) ....................................................................................................... $ ___________________

3. Net Taxable Value (line 1 minus line 2) .................................................................................... $ ___________________

4. Tax (line 3 X 17%) ................................................................................................................. $ ___________________

5. Less Discount, if applicable (line 4 X 2.5%) ........................................................................... $ ___________________

6. Interest on Late Payment (see instructions) ............................................................................ $ ___________________

S

I

EE

NSTRUCTIONS

7. Late Filing Charge ($50 or 10% of line 4, whichever is greater) .............................................. $ ___________________

8. Total Amount Due (line 4 minus 5, or line 4 plus lines 6 & 7) ................................................... $ ___________________

Make remittance payable to Treasurer of State of Ohio and mail to Treasurer of State, P.O. Box 1568, Columbus, OH 43216-1568. This

return must be received by the last day of the month following the reporting period.

I declare under penalties of perjury that this return, including any accompanying schedules and statements, has

been examined by me and, to the best of my knowledge and belief, is a true, correct and complete return and

report.

Signature ____________________________________________ Title ________________________________________

Date _______________________________________________

See Instructions on reverse side.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1