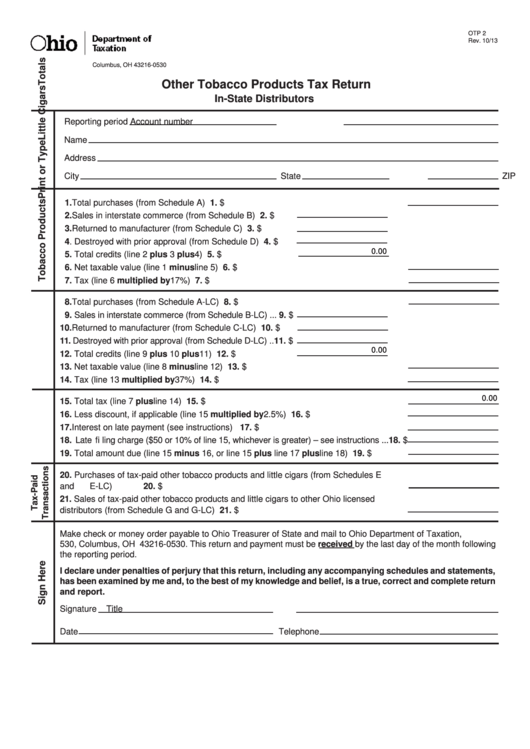

Reset Form

OTP 2

Rev. 10/13

P.O. Box 530

Columbus, OH 43216-0530

Other Tobacco Products Tax Return

In-State Distributors

Reporting period

Account number

Name

Address

City

State

ZIP code

1. Total purchases (from Schedule A) ........................................................................... 1. $

2. Sales in interstate commerce (from Schedule B) ........ 2. $

3. Returned to manufacturer (from Schedule C) ............. 3. $

4. Destroyed with prior approval (from Schedule D) ....... 4. $

0.00

5. Total credits (line 2 plus 3 plus 4) .............................. 5. $

6. Net taxable value (line 1 minus line 5) ..................................................................... 6. $

7. Tax (line 6 multiplied by 17%) ................................................................................. 7. $

8. Total purchases (from Schedule A-LC) ..................................................................... 8. $

9. Sales in interstate commerce (from Schedule B-LC) ... 9. $

10. Returned to manufacturer (from Schedule C-LC) ..... 10. $

11. Destroyed with prior approval (from Schedule D-LC) ..11. $

0.00

12. Total credits (line 9 plus 10 plus 11) ........................ 12. $

13. Net taxable value (line 8 minus line 12) ................................................................. 13. $

14. Tax (line 13 multiplied by 37%) ............................................................................. 14. $

0.00

15. Total tax (line 7 plus line 14) ................................................................................... 15. $

16. Less discount, if applicable (line 15 multiplied by 2.5%) ....................................... 16. $

17. Interest on late payment (see instructions) ............................................................ 17. $

18. Late fi ling charge ($50 or 10% of line 15, whichever is greater) – see instructions ... 18. $

19. Total amount due (line 15 minus 16, or line 15 plus line 17 plus line 18) ............. 19. $

20. Purchases of tax-paid other tobacco products and little cigars (from Schedules E

and E-LC) ................................................................................................................ 20. $

21. Sales of tax-paid other tobacco products and little cigars to other Ohio licensed

distributors (from Schedule G and G-LC) ............................................................... 21. $

Make check or money order payable to Ohio Treasurer of State and mail to Ohio Department of Taxation, P.O. Box

530, Columbus, OH 43216-0530. This return and payment must be received by the last day of the month following

the reporting period.

I declare under penalties of perjury that this return, including any accompanying schedules and statements,

has been examined by me and, to the best of my knowledge and belief, is a true, correct and complete return

and report.

Signature

Title

Date

Telephone

1

1 2

2