Alcohol Beverage Tax Information - 2004 Page 4

ADVERTISEMENT

July 2004

Wisconsin Department of Revenue

by the department’s Alcohol & Tobacco Enforcement Sec-

Persons holding the above permits are either exempt from

tion. Out-of-state shippers should call the department at

the beverage tax (1 through 4), do not actually own the

(608) 261-6435 when in doubt as to whether a person in

products being sold (5 & 6), or only buy products on which

Wisconsin is authorized to receive products. Alcohol bev-

the tax has already been paid (7, 8, 9 & 10).

erages found in Wisconsin on which the tax has not been

paid also may be confiscated. In addition, any alcohol bev-

B. BEVERAGE TAX RETURNS TO FILE

erage product possessed or sold under the wrong permit

Return must be filed by permittees even when they do

may result in confiscation of product. Persons who have

not have any transactions during a month, and there-

product confiscated by the department may also be sub-

fore do not owe any tax. In these instances, simply

ject to criminal prosecution.

indicate “no shipments” on your return.

• Additional Location – If you begin operations at another

1. Liquor Tax Returns

location other than the location covered by your permit,

Persons holding a liquor permit with the department

contact the department’s Registration Unit at (608) 261-

who are required to file a monthly beverage tax return

6435 immediately because you must obtain a permit for

file form AB-130 plus schedules. There is only one li-

the additional location.

quor tax return regardless of the nature of your busi-

ness unlike beer tax which has four different types of

• Reporting Name/Address/Ownership Changes or Ceas-

returns that may be filed depending on the permit held

ing Operations – You should notify the department in writ-

with the department. All alcohol beverages reportable

ing when your business undergoes any change to its name,

on a liquor tax return must be expressed in liters.

address or ownership, or when you cease operating in

Wisconsin. If you receive a different Federal Employer Iden-

• Brand and Type Schedule – Permittees liable for pay-

tification Number, you must file a new application with the

ing the tax on distilled spirits to the department must

department and update your security. Call (608) 261-6435

submit with their monthly reports a schedule listing dis-

if you have any questions about your permit.

tilled spirits (by brand and type) shipped to Wisconsin

that month. Call the department at (608) 266-6702 for

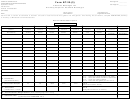

V. FILING TAX RETURNS

a sample schedule format for the listing.

After your application for an alcohol beverage permit has

• Out-of-state Shippers Holding More Than One Per-

been approved by the department, you will be sent a sup-

mit Should File a Consolidated Liquor Tax Return (AB-

ply of reporting forms along with your permit. The report-

130) – Out-of-state shippers holding more than one

ing forms you receive depend upon the type of permit you

permit with the department should file one monthly li-

are issued.

quor tax return on which all liquor transactions are con-

solidated. These shippers will have to let us know the

A. WHO MUST FILE TAX RETURNS

location from which the consolidated return will be filed.

Most alcohol beverage permittees registered with the Wis-

consin Department of Revenue must complete and file a

2. Beer Tax Returns

return with the department summarizing their transactions

The four beer tax returns are:

and computing any tax due (see Part II and the exceptions

1. Wisconsin Brewery Fermented Malt Beverage Tax

below).

Return, BT-100.

2. Wisconsin Wholesaler’s Report of Tax-Paid Beer,

Persons holding the following liquor and/or beer per-

BT-104 (a zero tax informational report).

mits with the department do not have to file monthly

3. Fermented Malt Beverage Tax Return, BT-106,

tax returns:

(filed by out-of-state shippers).

4. Wisconsin Wholesalers’ Return of Imported Beer,

1. Wisconsin industrial wine permit

BT-108.

2. Wisconsin industrial alcohol permit

3. Sacramental wine permit

All beer reportable on the BT-100, 106 & 108 must be

4. Medicinal alcohol permit

expressed in barrels.

5. Wisconsin and out-of-state liquor salespersons

3. Common Carrier Return

6. Wisconsin public warehouse

7. Sports club retail liquor and beer permits

Common carriers that operate in Wisconsin (for ex-

8. Vessel retail liquor and beer permits

ample, trains and airplanes) on which alcohol bever-

9. Public facility & airport retail liquor permits

ages are consumed must file a quarterly return with

10. Wisconsin beer wholesalers who deal exclu-

the department and pay the tax on the beverages con-

sively with other Wisconsin beer wholesalers

sumed in the state. Carriers are not required to obtain

(but file an informational report)

a permit from the department. The return (AB-154) they

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6