Form Rv-3 - Annual Rental Motor Vehicle And Tour Vehicle Surcharge Tax Return - Instructions - 2004 Page 3

ADVERTISEMENT

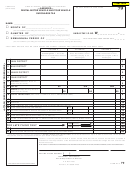

STEP 5 — Enter the totals for Lines 1 through 4 of Columns A through C in these spaces.

In Column A, Line 5, BTK has entered 10,140, the total number of rental motor vehicle-days. In Column B, Line 5, BTK

has entered 22, the total number of tour vehicle (8-25 passengers)-months. In Column C, Line 5, BTK has entered 12, the

total number of tour vehicle (40 passenger)-months.

STEP 6a — In Column A, multiply the number entered on Line 5 by the tax rate of $3 (Line 6) and enter the result on

Column A, Line 7.

BTK has multiplied 10,140 (the number of vehicle-days) entered on Line 5 by $3 (the tax rate listed on Line 6) to get

$30,420, which is entered in Column A, Line 7 (10,140 x $3 = $30,420).

STEP 6b — In Column B, multiply the number entered on Line 5 by the tax rate of $15 (Line 6), and enter the result on

Line 7.

BTK has multiplied 22 (the number of tour vehicle (8-25 passenger)-months) entered on Line 5 by $15 (the tax rate listed

on Line 6) to get $330, which is entered in Column B, Line 7 (22 x $15 = $330).

STEP 6c — In Column C, multiply the number entered on Line 5 by the tax rate of $65 (Line 6), and enter the result on

Line 7.

BTK has multiplied 12 (the number of tour vehicle (26 or more passengers)-months) entered on Line 5 by $65 (the tax rate

listed on Line 6) to get $780, which is entered in Column C, Line 7 (12 x $65 = $780).

W _ _ _ _ _ _ _ _ - _ _

HAWAII TAX I.D. NO.

1 2 3 4 5 6 7 8 0 1

COLUMN A

COLUMN B

COLUMN C

Rental Motor Vehicle

Tour Vehicle Surcharge Tax

Tour Vehicle Surcharge Tax

4

4

4

Surcharge Tax — Enter the

Enter the Number of Tour

Enter the Number of Tour

Number of Rental Motor Vehicle

Vehicles Carrying 8 - 25

Vehicles Carrying 26 or More

Days

Passengers

Passengers

1 OAHU DISTRICT

1

6,900

22

12

2 MAUI DISTRICT

2

3,240

3 HAWAII DISTRICT

3

4 KAUAI DISTRICT

4

5

5

5

5 TOTALS

(Add lines 1 thru 4 of

10,140

22

12

5

columns A, B, and C)

$15

$65

6 RATES

$3

6

6b

6c

6a

7 TAXES

(Multiply line 5 by line 6 of

7

30,420

330

780

columns A, B, and C)

00

00

00

7

8 TOTAL TAXES (Add line 7 columns A thru C and enter here)

8

fig. 3.1

FINISHING THE TAX RETURN (fig. 3.2)

STEP 7 — Add Columns A through C, Line 7, and enter the total on Line 8. This is the total tax due. CAUTION: LINE 8

MUST BE FILLED IN. If you do not have any rental motor vehicle or tour vehicle activity and therefore have no tax due,

enter a zero (0) on Lines 8 and 17.

BTK has added $30,420, $330, and $780 for a total of $31,530 which is entered on Line 8.

STEP 8 — On Lines 9 and 10, add all the penalties and interest which have been assessed on taxes owed on the periodic

tax returns for the taxable year.

STEP 9 — Add Lines 8, 9, and 10, and enter the result on Line 11.

STEP 10 — Add the total amount of rental motor vehicle and tour vehicle surcharge taxes paid with your periodic tax

returns and any delinquency notices for the taxable year. Enter this amount on Line 12.

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5