Form Rv-3 - Annual Rental Motor Vehicle And Tour Vehicle Surcharge Tax Return - Instructions - 2004 Page 4

ADVERTISEMENT

STEP 11 — Enter the amount of tax paid with any assessment notices for the taxable year on Line 13.

STEP 12 — Enter the amount of any penalty paid with your periodic tax returns, delinquency notices, or assessment

notices for the taxable year on Line 14 in the space provided to the right of “Penalties $.”

STEP 13 — Enter the amount of any interest paid with your periodic tax returns, delinquency notices, or assessment

notices for the taxable year on Line 14 in the space provided to the right of “Interest $.”

STEP 14 — Add the amount of penalty and interest paid, and enter the total on Line 14.

STEP 15 — Add the amounts on Lines 12 through 14, and enter the total on Line 15.

STEP 16 — Compare the amounts on Lines 11 and 15. If the amount on Line 11 is THE SAME AS Line 15, enter “0” on

Line 17, and go on to Step 21 below.

If the amount on Line 11 is LESS THAN Line 15, subtract Line 11 from Line 15, and enter the result on Line 16 (this is

your credit to be refunded to you), and go to Step 21 below.

STEP 17 — If the amount on Line 11 is MORE THAN Line 15, subtract Line 15 from Line 11 and enter the result on Line

17. This is your taxes now due and payable. Calculate penalty and interest on this amount if the annual return is filed

after the due date. If you had no activity for the entire year, enter “0” on Line 17. Please note that this return must still be

filed.

STEP 18 — If there is tax due on the return and you file and pay after the due date, then penalty is assessed at the rate of

5% per month, or part of a month, from the due date to the filing date, to a maximum of 25%. Interest is assessed at the

rate of 2/3 of 1% per month, or part of a month, on the unpaid tax and penalty will be charged.

Enter the amounts for Penalty and Interest on Lines 18a and 18b, respectively. Add Lines 18a and 18b and enter the

result on Line 18.

If you are unable to compute the penalty and interest, leave Lines 18a and 18b blank. The

Department will compute it for you and send you a bill.

STEP 19 — If you have taxes due now, add the amounts on Lines 17 and 18 and enter the result on Line 19.

STEP 20 — If you have an amount on Line 19, please enter the amount of payment to be remitted with this return on Line

20. If you are not making a payment, enter a zero (0).

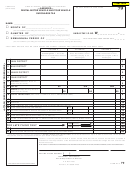

6a

30,420

330

780

7

columns A, B, and C)

00

00

00

7

8 TOTAL TAXES (Add line 7, columns A thru C, and enter here)

8

31,530 00

9 PENALTY

8

9

10 INTEREST

10

9

11 TOTAL AMOUNT DUE (Add lines 8, 9, and 10; Enter amount here)

11

31,530 00

10

12

12

12

Total taxes paid on monthly, quarterly, or semiannual returns for the period.

31,530 00

11

13

13

13

Additional assessments paid for the period, if included above.

14

12

13

14

14

14

Penalties $ ___________ Interest $ ___________ paid during the period.

15

15 TOTAL PAYMENTS MADE (Add lines 12, 13, and 14)

15

31,530 00

16

16 CREDIT TO BE REFUNDED (Line 15 minus line 11)

16

17

TOTAL TAXES DUE (Line 11 minus

IF YOU DO NOT HAVE ANY ACTIVITY, AND THE RESULT IS NO TAX LIABILITY, ENTER “0" ON

17

00

line 15)

17

LINES 8 AND 17 . THIS RETURN MUST BE FILED.

18

18a

PENALTY

FOR LATE FILING ONLY

18

18b

INTEREST

19

19 TOTAL AMOUNT NOW DUE AND PAYABLE (Add lines 17 and 18)

19

20

ATTACH YOUR CHECK OR MONEY ORDER PAYABLE TO

PLEASE ENTER AMOUNT OF

20

20

00

“HAWAII STATE TAX COLLECTOR” IN U.S. DOLLARS DRAWN ON ANY U.S.

YOUR PAYMENT

BANK AND FORM VP-1 TO FORM RV-3. WRITE “RV”, THE FILING PERIOD, AND

fig. 3.2

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5