Instructions For Form Rc-27-B - Illinois Department Of Revenue

ADVERTISEMENT

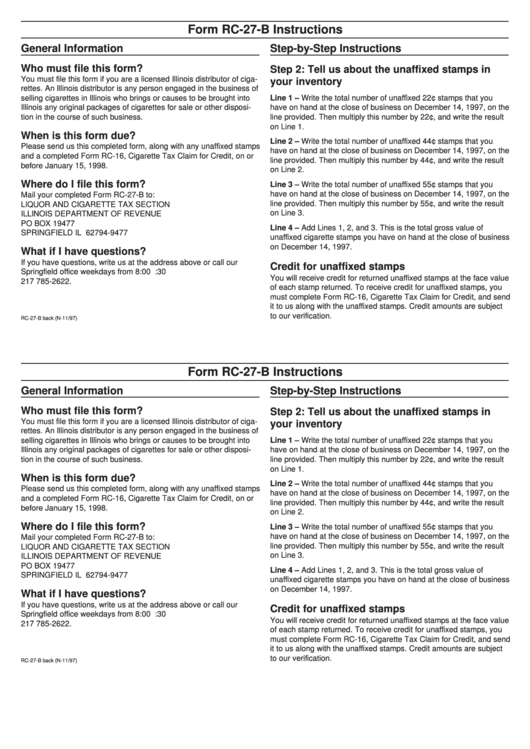

Form RC-27-B Instructions

General Information

Step-by-Step Instructions

Who must file this form?

Step 2: Tell us about the unaffixed stamps in

You must file this form if you are a licensed Illinois distributor of ciga-

your inventory

rettes. An Illinois distributor is any person engaged in the business of

selling cigarettes in Illinois who brings or causes to be brought into

Line 1 – Write the total number of unaffixed 22¢ stamps that you

Illinois any original packages of cigarettes for sale or other disposi-

have on hand at the close of business on December 14, 1997, on the

tion in the course of such business.

line provided. Then multiply this number by 22¢, and write the result

on Line 1.

When is this form due?

Line 2 – Write the total number of unaffixed 44¢ stamps that you

Please send us this completed form, along with any unaffixed stamps

have on hand at the close of business on December 14, 1997, on the

and a completed Form RC-16, Cigarette Tax Claim for Credit, on or

line provided. Then multiply this number by 44¢, and write the result

before January 15, 1998.

on Line 2.

Where do I file this form?

Line 3 – Write the total number of unaffixed 55¢ stamps that you

have on hand at the close of business on December 14, 1997, on the

Mail your completed Form RC-27-B to:

line provided. Then multiply this number by 55¢, and write the result

LIQUOR AND CIGARETTE TAX SECTION

on Line 3.

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19477

Line 4 – Add Lines 1, 2, and 3. This is the total gross value of

SPRINGFIELD IL 62794-9477

unaffixed cigarette stamps you have on hand at the close of business

on December 14, 1997.

What if I have questions?

If you have questions, write us at the address above or call our

Credit for unaffixed stamps

Springfield office weekdays from 8:00 a.m. to 4:30 p.m. at

You will receive credit for returned unaffixed stamps at the face value

217 785-2622.

of each stamp returned. To receive credit for unaffixed stamps, you

must complete Form RC-16, Cigarette Tax Claim for Credit, and send

it to us along with the unaffixed stamps. Credit amounts are subject

to our verification.

RC-27-B back (N-11/97)

Form RC-27-B Instructions

General Information

Step-by-Step Instructions

Who must file this form?

Step 2: Tell us about the unaffixed stamps in

You must file this form if you are a licensed Illinois distributor of ciga-

your inventory

rettes. An Illinois distributor is any person engaged in the business of

selling cigarettes in Illinois who brings or causes to be brought into

Line 1 – Write the total number of unaffixed 22¢ stamps that you

Illinois any original packages of cigarettes for sale or other disposi-

have on hand at the close of business on December 14, 1997, on the

tion in the course of such business.

line provided. Then multiply this number by 22¢, and write the result

on Line 1.

When is this form due?

Line 2 – Write the total number of unaffixed 44¢ stamps that you

Please send us this completed form, along with any unaffixed stamps

have on hand at the close of business on December 14, 1997, on the

and a completed Form RC-16, Cigarette Tax Claim for Credit, on or

line provided. Then multiply this number by 44¢, and write the result

before January 15, 1998.

on Line 2.

Where do I file this form?

Line 3 – Write the total number of unaffixed 55¢ stamps that you

have on hand at the close of business on December 14, 1997, on the

Mail your completed Form RC-27-B to:

line provided. Then multiply this number by 55¢, and write the result

LIQUOR AND CIGARETTE TAX SECTION

on Line 3.

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19477

Line 4 – Add Lines 1, 2, and 3. This is the total gross value of

SPRINGFIELD IL 62794-9477

unaffixed cigarette stamps you have on hand at the close of business

on December 14, 1997.

What if I have questions?

If you have questions, write us at the address above or call our

Credit for unaffixed stamps

Springfield office weekdays from 8:00 a.m. to 4:30 p.m. at

You will receive credit for returned unaffixed stamps at the face value

217 785-2622.

of each stamp returned. To receive credit for unaffixed stamps, you

must complete Form RC-16, Cigarette Tax Claim for Credit, and send

it to us along with the unaffixed stamps. Credit amounts are subject

to our verification.

RC-27-B back (N-11/97)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1