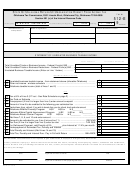

2016 Form 512E - Page 2 - Return of Organization Exempt from Income Tax

Schedule 512E-X: Amended Return Schedule

Did you file an amended Federal income tax return?

Yes

No

A

Provide a copy of the amended Federal return and a copy of “Statement of Adjustment”, IRS refund check or deposit slip.

If this return is being filed due to a Federal audit, furnish a complete copy of the RAR.

B

Explanation or Reason for Amended Return (Provide all necessary schedules):

C

_________________________________________________________________________________________

_________________________________________________________________________________________

_________________________________________________________________________________________

_________________________________________________________________________________________

Instructions for filing an Amended Return

When filing an amended return, place an “X” in the Amended Return check-box at the top of page 1. Enter any amount(s) paid with the

original return plus any amount(s) paid after it was filed on line 9. Enter any refund previously received or overpayment applied on line

10. Complete the Amended Return Schedule, Schedule 512E-X above.

Provide the amended Federal return and proof of disposition by the Internal Revenue Service when applicable.

An overpayment on an amended return may not be credited to estimated tax, but will be refunded. The amount applied to estimated tax

on the original return cannot be adjusted.

General Instructions

•

Every organization shall make a return for each year. 68 Oklahoma Statutes (OS) Section 2368.

•

Parts 1 and 3 must be completed by all organizations. If you were required to file an annual information return with the Internal

Revenue Service, enclose a copy of the information return including any supporting schedules (e.g. Form 990, 990-EZ, 990-PF).

•

Part 2 is to be completed by organizations who have unrelated trade or business income. If you were required to file an income tax

return with the Internal Revenue Service, enclose a copy of the tax return including any supporting schedules (e.g. Form 990-T).

•

Corporate returns shall be due no later than 30 days after the due date established under the Internal Revenue Code.

•

Exempt Organizations are subject to tax on unrelated business income. 68 OS Sec. 2359.

•

Investment income of Exempt Organizations subject to Federal Excise tax is not subject to Oklahoma Income Tax; however, any

income subject to income tax under the Internal Revenue Code is subject to Oklahoma Income Tax.

•

Complete the Oklahoma Statement of Unrelated Business Income and attach a schedule of any other taxable income.

•

Total Unrelated Trade or Business Deductions includes the “specific deduction” allowed on the Federal return.

•

If you do not have a Federal Employer Identification Number, you may obtain one by visiting the IRS website at

NOTE: If exempt organization is a trust, the following rates apply.

If taxable income is:

At least

But less than

-0-

1,000

Pay .......... 1/2 of 1% of Taxable Income

-

1,000

2,500

Pay ..........

5.00

+

1%

over ........... 1,000

-

2,500

-

3,750

Pay .......... 20.00

+

2%

over ........... 2,500

3,750

-

4,900

Pay .......... 45.00

+

3%

over ........... 3,750

4,900

7,200

Pay .......... 79.50

+

4%

over ........... 4,900

-

7,200

over

Pay .......... 171.50

+

5%

over ........... 7,200

-

The Oklahoma Tax Commission is not required to give actual notice to taxpayers of changes in any state tax law.

Mail to:

Oklahoma Tax Commission

P.O. Box 26800

Oklahoma City, Oklahoma 73126-0800

1

1 2

2