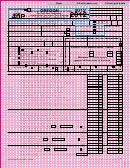

2015 Form 40P

Name

SSN

00611501020000

Federal column (F)

Oregon column (S)

Income

7 Wages, salaries, and other pay for work. Include all

•

.00

.00

Forms W-2 .............................................................................. 7F

7S

•

.00

.00

8 Taxable interest income from federal Form 1040, line 8a ....... 8F

8S

•

.00

.00

9 Dividend income from federal Form 1040, line 9a .................. 9F

9S

10 State and local income tax refunds from federal

•

.00

.00

Form 1040, line 10 ................................................................... 10F

10S

•

.00

.00

11 Alimony received from federal Form 1040, line 11 .................. 11F

11S

•

.00

.00

12 Business income or loss from federal Form 1040, line 12 ...... 12F

12S

•

.00

.00

13 Capital gain or loss from federal Form 1040, line 13 .............. 13F

13S

•

.00

.00

14 Other gains or losses from federal Form 1040, line 14 ........... 14F

14S

•

.00

.00

15 IRA distributions from federal Form 1040, line 15b ................. 15F

15S

•

.00

.00

16 Pension and annuities from federal Form 1040, line 16b ........ 16F

16S

•

.00

.00

17 Schedule E income from federal Form 1040, line 17 .............. 17F

17S

•

.00

.00

18 Farm income or loss from federal Form 1040, line 18 ............ 18F

18S

19 Unemployment and other income from federal Form 1040,

•

.00

.00

lines 19 through 21 .................................................................. 19F

19S

•

•

.00

.00

20 Total income. Add lines 7 through 19 ...................................

20F

20S

Adjustments

21 IRA or SEP and SIMPLE contributions, federal Form 1040,

•

•

.00

.00

lines 28 and 32 .....................................................................

21F

21S

22 Education deductions from federal Form 1040,

•

•

.00

.00

line 23, 33, and 34 ................................................................

22F

22S

•

•

.00

.00

23 Moving expenses from federal Form 1040, line 26 ..............

23F

23S

24 Deduction for self-employment tax from federal

•

•

.00

.00

Form 1040, line 27 ................................................................

24F

24S

25 Self-employed health insurance deduction from federal

•

•

.00

.00

Form 1040, line 29 ................................................................

25F

25S

•

•

.00

.00

26 Alimony paid from federal Form 1040, line 31a ...................

26F

26S

•

•

.00

.00

27 Total adjustments from Schedule OR-ASC-N/P, section 1 ..

27F

27S

•

•

.00

.00

28 Total adjustments. Add lines 21 through 27 .........................

28F

28S

•

•

.00

.00

29 Income after adjustments. Line 20 minus line 28 .................

29F

29S

•

•

.00

.00

Additions

30 Total additions from Schedule OR-ASC-N/P, section 2 .......

30F

30S

•

•

.00

.00

31 Income after additions. Add lines 29 and 30........................

31F

31S

Subtractions

32 Social Security and tier 1 Railroad Retirement Board

•

.00

benefits included on line 19F ...............................................

32F

•

•

.00

.00

33 Other subtractions from Schedule OR-ASC-N/P, section 3 .

33F

33S

•

•

.00

.00

34 Income after subtractions. Line 31 minus lines 32 and 33 ...

34F

34S

•

.

35 __ __ __

__ %

35 Oregon percentage. Line 34S ÷ line 34F (not more than 100.0%) .........

•

.00

Deductions

36 Amount from line 34F .....................................................................................................................

36

•

.00

and

37 Itemized deductions from federal Schedule A, line 29 ...................................................................

37

•

.00

modifications

38 State income tax claimed as itemized deduction ..........................................................................

38

•

.00

39 Net Oregon itemized deductions. Line 37 minus line 38................................................................

39

•

.00

40 Standard deduction ........................................................................................................................

40

•

•

•

•

40a You were:

65 or older;

Blind. Your spouse was:

65 or older;

Blind.

•

.00

41 Enter the larger of line 39 or line 40 ...............................................................................................

41

•

.00

42 2015 federal tax liability ($0–$6,450; see instructions for the correct amount) ...........................

42

•

.00

43 Total modifications from Schedule OR-ASC-N/P, section 4...........................................................

43

•

.00

44 Add lines 41, 42, and 43 ................................................................................................................

44

•

.00

45 Taxable income. Line 36 minus line 44. If line 44 is more than line 36, enter -0- ...........................

45

Page 2

150-101-055 (Rev. 12-15)

1

1 2

2 3

3 4

4