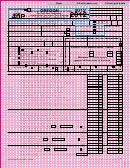

2015 Form 40P

Name

SSN

00611501030000

•

.00

46 Taxable income from line 45. .........................................................................................................

46

•

.00

Oregon tax

47 Tax. See instructions. Enter tax on line 47. Check if tax is from: ...................................................

47

•

•

•

47a

Form FIA-40P;

47b

Worksheet FCG;

47c

Schedule OR-PTE-PY.

•

.00

48 Oregon income tax. Line 47 multiplied by the Oregon percentage from line 35 .......................

48

•

.00

49 Interest on certain installment sales ...............................................................................................

49

•

.00

50 Total tax before credits. Add lines 48 and 49 .................................................................................

50

•

.00

Nonrefundable 51 Exemption credit. See instructions ..............................................................................................

51

•

.00

credits

52 Total standard credits from Schedule OR-ASC-N/P, section 5 ......................................................

52

•

.00

53 Total carryforward credits from Schedule OR-ASC-N/P, section 6 ................................................

53

•

.00

54 Line 50 minus lines 51, 52, and 53. If less than zero, enter -0- .....................................................

54

•

.00

Payments and

55 Oregon income tax withheld from income. Include Forms W-2 and 1099 ..................................

55

•

.00

refundable

56 Amount applied from your prior year’s tax refund ..........................................................................

56

credits

57 Estimated tax payments for 2015. Include all payments made prior to the filing date of this

•

.00

return, including real estate transactions. Do not include the amount already reported on line 56 ...

57

•

.00

58 Tax payments from a pass-through entity ......................................................................................

58

59 Oregon surplus credit (kicker). Enter your kicker amount; see instructions.

•

.00

If you elect to donate your kicker to the State School Fund, enter -0- and see line 75. .......

59

•

.00

60 Total refundable credits from Schedule OR-ASC-N/P, section 7 ...................................................

60

•

.00

61 Total payments and refundable credits. Add lines 55 through 60 ..................................................

61

•

.00

Tax to pay

62 Overpayment of tax. If line 54 is less than line 61, you overpaid. Line 61 minus line 54 ............

62

•

.00

or refund

63 Net tax. If line 54 is more than line 61, you have tax to pay. Line 54 minus line 61 .....................

63

.00

64 Penalty and interest for filing or paying late. See instructions .......................................................... 64

•

.00

65 Interest on underpayment of estimated tax. Include Form 10 ......................................................

65

•

•

Exception number from Form 10, line 1:

65a

. Check box if you annualized:

65b .

.00

66 Total penalty and interest due. Add lines 64 and 65 ...................................................................... 66

•

.00

67 Tax to pay with penalty and interest. Line 63 plus line 66. ......... This is the amount you owe

67

68 Overpayment less penalty and interest. Is line 62 more than line 66?

•

.00

If so, Line 62 minus line 66. ........................................................................... This is your refund

68

•

.00

69 Estimated tax. Fill in the part of line 68 you want applied to your estimated tax .........................

69

•

.00

70 Total charitable checkoff donations from Schedule OR-D, line 30 ................................................

70

•

.00

71 Total Oregon 529 College Savings Plan deposits. See instructions ..............................................

71

•

.00

72 Total. Add lines 69 through 71. Total can’t be more than your refund on line 68 ...........................

72

•

.00

73 Line 68 minus line 72. This is your net refund ............................................................. Net refund

73

•

Direct deposit

74 For direct deposit of your refund, see instructions. Will this refund go to an account outside the United States?

Yes

•

•

Type of

Checking; or

Routing number:

•

account:

Savings.

Account number:

75 Oregon surplus credit (kicker) donation. If you elect to donate your kicker to the State School Fund, check

•

•

the box

and write the amount from line 7 of the Kicker Calculation Worksheet here:

75a _______________________

This election is irrevocable.

Page 3

150-101-055 (Rev. 12-15)

1

1 2

2 3

3 4

4