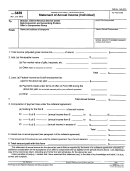

Form 1040-Es (Nr) - U.s. Estimated Tax For Nonresident Alien Individuals - Department Of The Treasury - 1992 Page 2

ADVERTISEMENT

2

Form 1040-ES (NR) 1992

Page

Payment Due Dates

Enter the amount you are sending in on the payment line of

the voucher. You may apply all or part of your 1991

overpayment to any voucher.

If you received wages subject to U.S. income tax withholding,

make your first estimated tax payment by April 15, 1992.

Enclose your payment, making the check or money order

Otherwise, make it by June 15, 1992. We do not send notices

payable to: “Internal Revenue Service” (Not “IRS”).

reminding you to make your estimated tax payments. You must

Do not staple or attach your payment to the voucher.

make each payment by the due date.

Write you social security number and “1992 Form 1040-ES”

Even if you are not required to make an estimated tax

on your check or money order.

payment on April 15 or June 15, 1992, you may meet the

Mail your payment-voucher to the Internal Revenue Service,

requirements to make estimated tax payments later. In this case,

P.O. Box 8318, Philadelphia, PA 19162-0825.

make your estimated tax payments as follows:

Fill in the Record of Estimated Tax Payments below for your

If the requirement to

Payment

Of the

files.

pay estimated tax is

date

estimated tax

If you changed your name and made estimated tax payments

met after:

is:

due, pay:

using your old name, attach a statement to the front of your

Mar. 31 and before June 1

June 15, 1992

1

⁄

2

1992 income tax return. List all of the estimated tax payments

May 31 and before Sept. 1

Sept. 15, 1992

⁄

you and your spouse made for 1992, the address where you

3

4

made the payments, and the name(s) and social security

Aug. 31

Jan. 15, 1993

all

number(s) under which you made the payments.

If you file your 1992 Form 1040NR by February 1, 1993, and

pay any balance due, then you do not have to make the

When a Penalty is Applied

payment that would otherwise be due January 15, 1993.

Fiscal Year Filers. If your return is on a fiscal year basis, your

In some cases, you may owe a penalty when you file your

due dates are the 15th day of the 4th, 6th, and 9th months of

return. The penalty is imposed on each underpayment for the

your fiscal year, and the 1st month of the following fiscal year. If

number of days it remains unpaid. A penalty may be applied if

any date falls on a Saturday, Sunday, or legal holiday, use the

you did not pay enough estimated tax, or you did not make the

next regular workday.

payments on time in the required amount. A penalty may apply

even if you have an overpayment on your tax return.

Amending Estimated Tax Payments

The penalty may be waived under certain conditions. See Pub.

505 for details.

To change or amend your estimated payments, first refigure your

estimated tax using the worksheet on page 3. From your new

Record of Estimated Tax Payments

estimated tax, subtract any amount of 1991 tax overpayment

(see this page for correct payment due dates)

credited to 1992 and any estimated payments made to date.

Make your remaining payments using the instructions for

Payment Due Dates on this page.

(c)

(d)

1991

Total amount

Payment

(a)

(b)

How To Complete and Use the

overpayment

paid and credited

number

Date

Amount paid

credit applied

(add (b) and (c))

Payment-Voucher

1

There is a separate voucher for each due date. Please be sure

2

you use the voucher with the correct due date shown in the

upper right hand corner. Complete and send in the voucher only

3

if a payment is due. To complete your voucher:

4

Type or print your name, address, and social security number

Total

in the space provided on the voucher.

1992 Tax Rate Schedules

Caution: Do not use these Tax Rate Schedules to figure your 1991 taxes. Use only to figure your 1992 estimated taxes.

Schedule X—

Schedule Y—

Single

Married filing separately

of the

of the

If line 5 is:

The tax is:

If line 5 is:

The tax is:

But not

amount

But not

amount

Over—

over—

over—

Over—

over—

over—

$0

$21,450

15%

$0

$0

$17,900

15%

$0

21,450

51,900

$3,217.50 + 28%

21,450

17,900

43,250

$2,685.00 + 28%

17,900

51,900

11,743.50 + 31%

51,900

43,250

9,783.00 + 31%

43,250

Schedule Z—

Qualifying widows and widowers

of the

If line 5 is:

The tax is:

But not

amount

Over—

over—

over—

$0

$35,800

15%

$0

35,800

86,500

$5,370.00 + 28%

35,800

86,500

19,566.00 + 31%

86,500

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5