Form Ol-3 - Net Profit License Fee Return - City Of Covington, Kentucky Page 2

ADVERTISEMENT

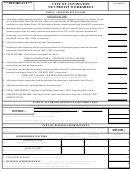

Account #

***IMPORTANT***

CITY OF COVINGTON

Enclose Copy of Applicable

NET PROFIT WORKSHEET

Federal Form(s)

PART I: ADJUSTED NET INCOME

BUSINESS INCOME

A)

All business entities enter the net profit or loss as shown on Federal Schedule C and/or E, the ordinary income

or loss from Federal Form 1065 or Form 1120S, the taxable income AFTER special deductions and net

operating loss from Federal Form 1120, the unrelated business taxable income from Form 990T, or equivalent.

B)

Individuals that report business income on Federal Schedule C and/or E, enter the gain or loss from the sale of

business property used in a trade or business from Federal Form 4797 or 6252 reported on Schedule D

C)

Partnerships and corporations that are pass-through entities for Federal tax purposes enter the additions from

Schedule K of Form 1065, 1120S, or equivalent

D) All business entities enter other income items (See Instructions)

E)

Partnerships and corporations that are pass-through entities for Federal tax purposes enter the allowable

subtractions from Schedule K of Form 1065, 1120S, or equivalent

TOTAL INCOME (Total of lines A through D less line E.)

F)

ITEMS NOT DEDUCTIBLE - ADDITIONS TO TOTAL INCOME

G)

All business entities add back the state income taxes and occupational license fees based on net or gross

income deducted from the Federal return

H)

Corporations add back the net operating loss allowed under Section172 of the Internal Revenue Code

deducted from Federal Form 1120, 1120-REIT, 990T, or equivalent

ITEMS NOT TAXABLE - SUBTRACTIONS FROM TOTAL INCOME

I) All business entities subtract the alcoholic beverage sales deduction as calculated in Part II, Line 3

J) All business entities enter other adjustments (See Instructions)

TOTAL ADJUSTMENTS (Add lines G and H then subtract lines I and J. Enter the total on line K)

K)

L)

ADJUSTED NET INCOME (Add lines F and K. Enter total here and on front, line 1 of Part IV: FEE

COMPUTATION)

PART II: ALCOHOLIC BEVERAGE SALES DEDUCTION

NOTE: “Total Sales” is Total Gross Receipts of Business including Non-Alcoholic Beverage Sales

Kentucky Alcoholic Beverage Sales

DIVIDE→

=

1)

%

Total Sales

2) Enter the total of line F of Part I: ADJUSTED NET INCOME

3) Alcoholic Beverage Sales Deduction (Multiply line 1 by line 2. Enter here and line I, Part I)

PART III: BUSINESS APPORTIONMENT

All licensees whose business operations were not conducted entirely in the City of Covington must complete this part, regardless

DIVIDE↓

of profit or loss.

COLUMN A

COLUMN B

COLUMN C

City of Covington

Everywhere

A / B = C

APPORTIONMENT FACTORS

PAYROLL FACTOR

1)

%

Compensation Paid or Payable to Employees

SALES FACTOR

2)

%

Gross Receipts from Sales, Rents, Work or Services Performed

3)

(Add Lines 1 and 2 of Column C)

TOTAL PERCENTAGES

%

4) BUSINESS APPORTIONMENT

(If your business had both a sales factor and a payroll factor, then

%

divide line 3 by two (2). However, if the business had either a sales factor or a payroll factor, but not both, then enter

the single factor percentage here and on front, Line 2 of Part IV: FEE COMPUTATION.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6