Form Ol-3 - Net Profit License Fee Return - City Of Covington, Kentucky Page 5

ADVERTISEMENT

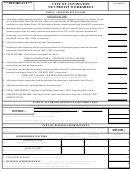

PART IV: FEE COMPUTATION

Line 1:

Complete PART I: ADJUSTED NET INCOME, then enter the total on line 1.

Line 2:

Enter 100% if business was conducted entirely within the City of Covington or Line 4 of PART III: BUSINESS APPORTIONMENT if business

was conducted within and without the City of Covington

Line 3:

Multiply line 1 by line 2. Enter the amount on line 3.

Multiply line 2 by 2.5%. Enter the amount on line 4.

Line 4:

Line 5:

Enter line 4 or $100, whichever is greater. Do not enter more than $40,000.

Line 6:

Enter any credits due from prepayment of estimated tax for the taxable year on line 6.

Subtract line 6 from line 5. Enter the amount on line 7.

Line 7:

Multiply line 7 by 5% for every month or fraction thereof , not to exceed 25% with the minimum of $25, if the NET PROFIT LICENSE FEE

Line 8:

RETURN FORM OL-3 is not filed by the due date or the extended due date granted or if the tax liability is not paid by the due date. Enter the

total on line 8.

Multiply line 7 by 1% for every month or fraction thereof, if the tax liability is not paid by the due date. Enter the total on line 9.

Line 9:

Add lines 7 through line 9. If the balance is a positive number, then enter the total due on Line 10 and pay the total due. If the balance is

Line 10:

negative go to Line 11.

Line 11:

If Line 10 is a negative number enter the overpayment on Line 11. Indicate if you desire to have the overpayment refunded or credited to next

year estimated payment.

PART I: ADJUSTED NET INCOME

Line A:

All business entities enter the net profit or loss as shown on Federal Schedule C, E, and/or F, the ordinary income or loss from Federal Form 1065

or Form 1120S, the taxable income AFTER special deductions and net operating loss from Federal Form 1120, the taxable income AFTER net

operating loss, total deduction for dividends paid, and section 857(b)(2)(E) deduction from Federal Form 1120-REIT, or the unrelated business

taxable income from Federal Form 990T.

Lines B through H are taxable income items which must be included in the adjusted net profit in order to determine the total net profit

license fee due. For items that do not apply to your business, enter 0 on the appropriate line.

Line B:

For individuals or sole proprietors that report business income on Federal Schedule C, E, and/or F, enter 100% of the short term capital gains and

long term capital gains carried over from Federal Form 4797 or Federal Form 6252 (installment sales) to Federal Schedule D representing gain

from the sale of property used in your trade or business. (Attach a copy of Form 4797 or Form 6252.)

Line C:

For partnerships or corporations that are pass-through entities for Federal tax purposes, the following income items which are allocated to the

partners and shareholders on Federal Schedule K are not included as income on Federal Form 1065 or 1120S; therefore, they must be added to

business income. Add the total income items from Schedule K and enter the amount on Line C.

*Net income from rental real estate activities

*Royalty income

*Net income from other rental activities

*Net short-term capital gain

*Interest income

*Net long-term capital gain

*Dividend income

*Other portfolio income

*Guaranteed payments to partners

* Net gain under Section 1231(other than due to casualty or theft)

Line D:

If a deduction is taken for any other amount which is deemed a taxable income item, then enter the amount on line D. For real estate investment

trusts, if a deduction is taken on Federal Form 1120-REIT for total dividends paid and Section 857(b)(2)(E), then the amount of the total

deductions must be added back to business income. Enter the amount on line D.

Line E:

For partnerships or corporations that are pass-through entities for Federal income tax purposes, the following items which are allocated to the

partners and shareholders on Federal Schedule K are not included as losses or expenses on Federal Form 1065 or Form 1120S, however, are

allowed as deductions for net profit license fee purposes. Add the total loss and deduction items from Schedule K and enter the amount on line E.

*Net loss from rental real estate activities

*Net short-term capital loss

*Net loss from other rental activities

*Net long-term capital loss

*Portfolio loss

*Charitable Contributions

*Net loss under Section 1231(other that due to casualty or theft)

*Deductions related to portfolio income

*Expense deductions for recovery property (Section 179)

NOTE: Contributions to KEOGH Plans, Simplified Employee Pension Plan, and Medical Insurance Premiums paid on behalf of partners and

deducted on Schedule K of Form 1065 are not deductible on the NET PROFIT LICENSE FEE RETURN FORM OL-3.

Line F:

ADD Lines A through D less line E. Enter the amount on Line F.

Line G:

If a deduction is taken on Schedule C, E, and/or F, Form 1065, Form 1120, Form 1120S, Form 1120-REIT, or Form 990T for state or local taxes

based on gross or net income, regardless of jurisdiction, then enter the amount of those taxes on Line G.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6