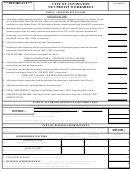

Form Ol-3 - Net Profit License Fee Return - City Of Covington, Kentucky Page 6

ADVERTISEMENT

PART I: ADJUSTED NET INCOME

For corporations, if a deduction is taken on Federal Form 1120, Form 1120-REIT, or 990-T for a net operating loss, then the amount of the net

Line H:

operating loss must be added back to business income. Enter the net operating loss amount on line H.

Lines I and J are non-taxable items which must be excluded from the adjusted net profit in order to determine the total net profit

license fee due. For items that do not apply to your business, enter 0 on the appropriate Line.

Line I:

For all business entities that sell alcoholic beverages, complete PART II: ALCOHOLIC BEVERAGE SALES DEDUCTION. Enter the total on

Line I. NOTE: A deduction may be taken only if the business engaged in the selling of alcoholic beverages had a profit.

Line J:

If any other income included on line F is deemed not subject to the license fee then enter the amount on line J and attach a full explanation,

including the amounts of all items. The following items are non-taxable items and are excluded from adjusted net profit.

*For partnerships, enter any amount of professional expenses claimed by the partners on their individual Form 1040 which are related to, but not

reimbursed by the partnership, (Attach Form 1040 and include a schedule listing partners name(s), the type of deduction and the amount of each

deduction.)

*If a credit is taken against the federal income tax liability in lieu of a deduction for business expense otherwise available to the licensee, the

business expense available for reduction as a result of the credit is a non-taxable item,

*Foreign dividend gross-up under Section 78 of the IRS Code,

*Income from controlled foreign corporations,

*Interest earned on U.S. Obligations, and

*Ordinary income or (loss) from other partnerships or S Corporations which is included in income on Line F of this part.

Line K:

ADD Lines G and H, then subtract lines I and J. Enter the total on Line K.

Line L:

Add lines F and K. Enter the ADJUSTED NET INCOME amount on line L and on the front page, line 1 of PART IV: FEE COMPUTATION.

Go to PART IV: FEE COMPUTATION.

PART II: ALCOHOLIC BEVERAGE SALES DEDUCTION

Persons having a portion of their business activity being derived from the manufacturing and/or selling of alcoholic beverages may exclude that portion of

their net profits derived from such sale of alcoholic beverage. A deduction may be taken only if the business engaged in the selling of alcoholic beverages

had a profit.

Divide the total Kentucky alcoholic beverage sales by the total gross receipts of the business, including the non-alcoholic beverage sales. Enter

Line 1:

the amount on line 1.

Line 2:

Enter the total income amount from line F of Part I: ADJUSTED NET INCOME.

Line 3:

Multiply line 1 by line 2. Enter the amount on line 3 and on line I of Part I: ADJUSTED NET INCOME. Go to Part I.

PART III: BUSINESS APPORTIONMENT

●

If 100% of your business is conducted within the City of Covington, do not complete PART II: BUSINESS APPORTIONMENT. Go to Page 1,

Line 2 of PART IV: FEE COMPUTATION and enter 100%, then follow the instructions for PART IV: FEE COMPUTATION.

●

All licensees whose business operations were not conducted entirely in the City of Covington must complete PART III: BUSINESS

APPORTIONMENT, regardless of profit or loss.

Payroll Factor

Line 1, Column A:

Enter the total compensation paid to employees for services rendered within the City of Covington during the period covered by the

tax return.

Line 1, Column B:

Enter the total compensation paid to employees for services rendered everywhere during the period covered by the tax return.

Line 1 Column C:

Divide Column A by Column B. Enter the result on Line 1, Column C.

Sales Factor

Line 2, Column A:

Enter the total gross receipts from sales, rents, and services in the ordinary course or usual trade of business earned within the City of

Covington during the period covered by the tax return.

Line 2, Column B:

Enter the total gross receipts from sales, rents, and services in the ordinary course or usual trade of business earned everywhere during

the period covered by the tax return.

Line 2, Column C:

Divide Column A by Column B. Enter the result on Line 2, Column C.

Business Apportionment

Add Column C, Lines 1 and 2. Enter the result on Line 3, Column C.

Line 3, Column C:

Line 4, Column C:

Divide Line 3, Column C by the number of percents used on Lines 1 and 2, Column C. Enter the result on Line 4, Column C and

Page 1, Line 6 of PART IV: FEE COMPUTATION, then follow the instructions for PART IV: FEE COMPUTATION.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6