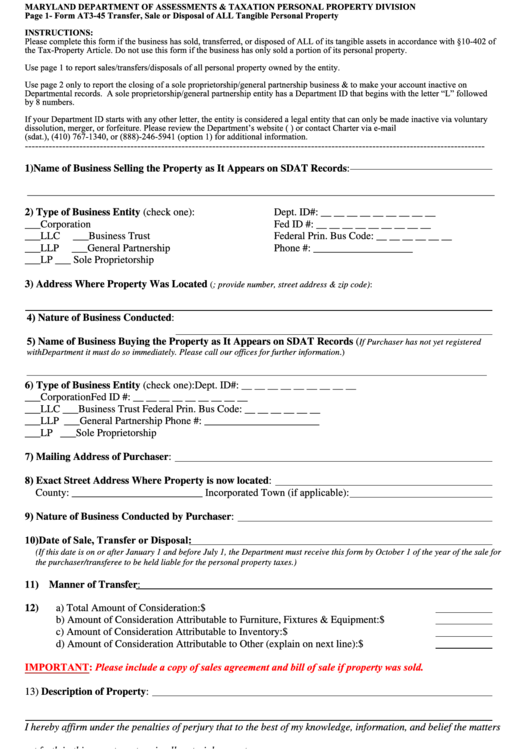

MARYLAND DEPARTMENT OF ASSESSMENTS & TAXATION PERSONAL PROPERTY DIVISION

Page 1- Form AT3-45 Transfer, Sale or Disposal of ALL Tangible Personal Property

INSTRUCTIONS:

Please complete this form if the business has sold, transferred, or disposed of ALL of its tangible assets in accordance with §10-402 of

the Tax-Property Article. Do not use this form if the business has only sold a portion of its personal property.

Use page 1 to report sales/transfers/disposals of all personal property owned by the entity.

Use page 2 only to report the closing of a sole proprietorship/general partnership business & to make your account inactive on

Departmental records. A sole proprietorship/general partnership entity has a Department ID that begins with the letter “L” followed

by 8 numbers.

If your Department ID starts with any other letter, the entity is considered a legal entity that can only be made inactive via voluntary

dissolution, merger, or forfeiture. Please review the Department’s website ( ) or contact Charter via e-mail

(sdat.charterhelp@maryland.gov), (410) 767-1340, or (888)-246-5941 (option 1) for additional information.

---------------------------------------------------------------------------------------------------------------------------------------

1) Name of Business Selling the Property as It Appears on SDAT Records:

________________________________________________________________________________________________________________________

2) Type of Business Entity (check one):

Dept. ID#: __ __ __ __ __ __ __ __ __

___Corporation

Fed ID #: __ __ __ __ __ __ __ __ __

___LLC

___Business Trust

Federal Prin. Bus Code: __ __ __ __ __ __

___LLP

___General Partnership

Phone #: ___________________

___LP

___ Sole Proprietorship

3) Address Where Property Was Located

(P.O. boxes are not acceptable; provide number, street address & zip code):

4) Nature of Business Conducted:

5) Name of Business Buying the Property as It Appears on SDAT Records (

If Purchaser has not yet registered

with Department it must do so immediately. Please call our offices for further information.)

_________________________________________________________________________________________________________

6) Type of Business Entity (check one):

Dept. ID#: __ __ __ __ __ __ __ __ __

___Corporation

Fed ID #: __ __ __ __ __ __ __ __ __

___LLC

___Business Trust

Federal Prin. Bus Code: __ __ __ __ __ __

___LLP

___General Partnership

Phone #: ______________________

___LP

___Sole Proprietorship

7) Mailing Address of Purchaser:

8) Exact Street Address Where Property is now located:

County: _________________________ Incorporated Town (if applicable):

9) Nature of Business Conducted by Purchaser:

10) Date of Sale, Transfer or Disposal:

(If this date is on or after January 1 and before July 1, the Department must receive this form by October 1 of the year of the sale for

the purchaser/transferee to be held liable for the personal property taxes.)

11) Manner of Transfer:

12)

a) Total Amount of Consideration:

$

b) Amount of Consideration Attributable to Furniture, Fixtures & Equipment:

$

c) Amount of Consideration Attributable to Inventory:

$

d) Amount of Consideration Attributable to Other (explain on next line):

$

IMPORTANT: Please include a copy of sales agreement and bill of sale if property was sold.

13) Description of Property:

I hereby affirm under the penalties of perjury that to the best of my knowledge, information, and belief the matters

set forth in this report are true in all material respects.

14) Date:

Signature:

Select One:

Print/Type Name:

Seller

Purchaser

4/2017

1

1 2

2