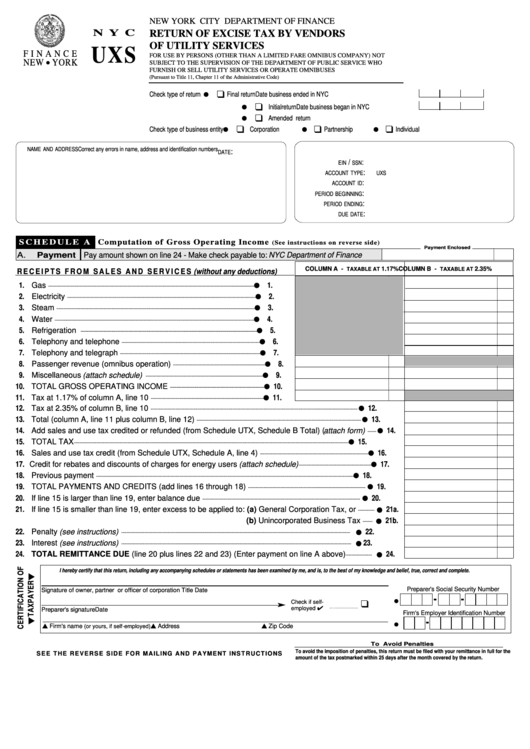

NEW YORK CITY DEPARTMENT OF FINANCE

N Y C

RETURN OF EXCISE TAX BY VENDORS

OF UTILITY SERVICES

UXS

F I N A N C E

FOR USE BY PERSONS (OTHER THAN A LIMITED FARE OMNIBUS COMPANY) NOT

NEW

YORK

l

SUBJECT TO THE SUPERVISION OF THE DEPARTMENT OF PUBLIC SERVICE WHO

FURNISH OR SELL UTILITY SERVICES OR OPERATE OMNIBUSES

(Pursuant to Title 11, Chapter 11 of the Administrative Code)

q

l

Check type of return ....................

Final return

Date business ended in NYC

q

l

Initial return

Date business began in NYC

q

l

Amended return

q

q

q

l

l

l

Check type of business entity ......

Corporation

Partnership

Individual

NAME AND ADDRESS Correct any errors in name, address and identification numbers

:

DATE

/

:

EIN

SSN

:

ACCOUNT TYPE

UXS

:

ACCOUNT ID

:

PERIOD BEGINNING

:

PERIOD ENDING

:

DUE DATE

S C H E D U L E A

Computation of Gross Operating Income

(See instructions on reverse side)

Payment Enclosed

A.

Payment

Pay amount shown on line 24 - Make check payable to: NYC Department of Finance

COLUMN A -

1.17%

COLUMN B -

2.35%

TAXABLE AT

TAXABLE AT

R E C E I P T S F R O M S A L E S A N D S E R V I C E S (without any deductions)

l

1. Gas

1.

····························································································································································································

l

2. Electricity

2.

············································································································································································

l

3. Steam

3.

·····················································································································································································

l

4. Water

4.

······················································································································································································

l

5. Refrigeration

5.

·································································································································································

l

6. Telephony and telephone

6.

······························································································································

l

7. Telephony and telegraph

7.

································································································································

l

8. Passenger revenue (omnibus operation)

8.

····················································································

l

9. Miscellaneous (attach schedule)

9.

···········································································································

l

10. TOTAL GROSS OPERATING INCOME

10.

······················································································

l

11. Tax at 1.17% of column A, line 10

11.

·······································································································

l

12. Tax at 2.35% of column B, line 10

12.

·····························································································································································································

l

13. Total (column A, line 11 plus column B, line 12)

13.

······················································································································································

l

14. Add sales and use tax credited or refunded (from Schedule UTX, Schedule B Total) ( attach form)

14.

········

l

15. TOTAL TAX

15.

···························································································································································································································································

l

16. Sales and use tax credit (from Schedule UTX, Schedule A, line 4)

16.

···································································································

l

17. Credit for rebates and discounts of charges for energy users (attach schedule)

17.

··································································

l

18. Previous payment

18.

···········································································································································································································································

l

19. TOTAL PAYMENTS AND CREDITS (add lines 16 through 18)

19.

···········································································································

l

20. If line 15 is larger than line 19, enter balance due

20.

················································································································································

21. If line 15 is smaller than line 19, enter excess to be applied to: (a) General Corporation Tax, or

l

21a.

···············

(b) Unincorporated Business Tax

l

21b.

·········

22. Penalty (see instructions)

l

22.

·················································································································································································································

23. Interest (see instructions)

l

23.

··················································································································································································································

l

24. TOTAL REMITTANCE DUE (line 20 plus lines 22 and 23) (Enter payment on line A above)

24.

························

I hereby certify that this return, including any accompanying schedules or statements has been examined by me, and is, to the b

est of my knowledge and belief, true, correct and complete.

Preparer's Social Security Number

Signature of owner, partner or officer of corporation

Title

Date

q

l

Check if self-

employed 4

Preparer's signature

Date

Firm's Employer Identification Number

l

s Firm's name

s Address

s Zip Code

(or yours, if self-employed)

To Avoid Penalties

To avoid the imposition of penalties, this return must be filed with your remittance in full for the

S E E T H E R E V E R S E S I D E F O R M A I L I N G A N D P A Y M E N T I N S T R U C T I O N S

amount of the tax postmarked within 25 days after the month covered by the return.

1

1 2

2 3

3