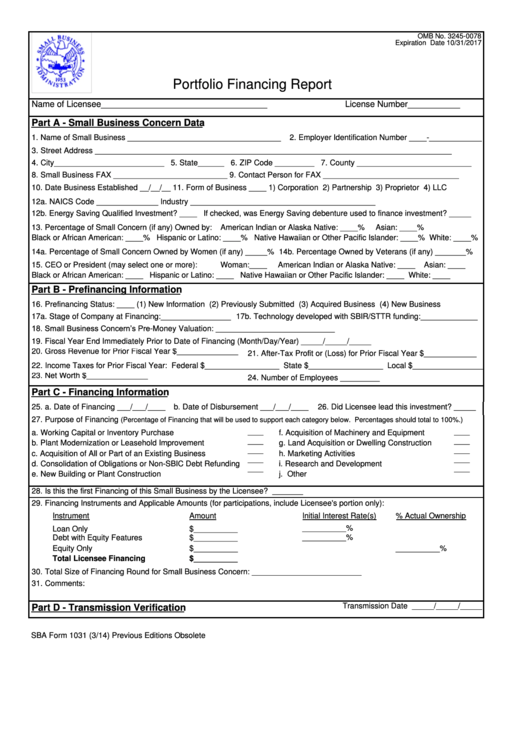

Sba Form 1031 - Portfolio Financing Report - U.s. Small Business Administration

ADVERTISEMENT

OMB No. 3245-0078

Expiration Date 10/31/2017

U.S. Small Business Administration

Portfolio Financing Report

Name of Licensee___________________________________

License Number___________

Part A - Small Business Concern Data

1. Name of Small Business ___________________________________

2. Employer Identification Number ____-____________

3. Street Address _________________________________________________________________________________

4. City_________________________ 5. State______ 6. ZIP Code _________ 7. County __________________________

8. Small Business FAX __________________________ 9. Contact Person for FAX _______________________________

10. Date Business Established __/__/__ 11. Form of Business ____ 1) Corporation 2) Partnership 3) Proprietor 4) LLC

12a. NAICS Code ______________ Industry __________________________________________

12b. Energy Saving Qualified Investment? ____ If checked, was Energy Saving debenture used to finance investment? _____

13. Percentage of Small Concern (if any) Owned by:

American Indian or Alaska Native: ____%

Asian: ____%

Black or African American: ____% Hispanic or Latino: ____% Native Hawaiian or Other Pacific Islander: ____% White: ____%

14a. Percentage of Small Concern Owned by Women (if any) _____% 14b. Percentage Owned by Veterans (if any) _______%

15. CEO or President (may select one or more):

Woman:____

American Indian or Alaska Native: ____

Asian: ____

Black or African American: ____ Hispanic or Latino: ____ Native Hawaiian or Other Pacific Islander: ____ White: ____

Part B - Prefinancing Information

16. Prefinancing Status: ____ (1) New Information (2) Previously Submitted (3) Acquired Business (4) New Business

17a. Stage of Company at Financing:________________ 17b. Technology developed with SBIR/STTR funding:_____________

18. Small Business Concern’s Pre-Money Valuation: ___________________________

19. Fiscal Year End Immediately Prior to Date of Financing (Month/Day/Year) _____/_____/_____

20. Gross Revenue for Prior Fiscal Year $______________

21. After-Tax Profit or (Loss) for Prior Fiscal Year $____________

22. Income Taxes for Prior Fiscal Year: Federal $_________________ State $_________________ Local $________________

23. Net Worth $______________

24. Number of Employees _________

Part C - Financing Information

25. a. Date of Financing ___/___/____

b. Date of Disbursement ___/___/____

26. Did Licensee lead this investment? _____

27. Purpose of Financing

(Percentage of Financing that will be used to support each category below. Percentages should total to 100%.)

____

____

a. Working Capital or Inventory Purchase

f. Acquisition of Machinery and Equipment

____

____

b. Plant Modernization or Leasehold Improvement

g. Land Acquisition or Dwelling Construction

____

____

c. Acquisition of All or Part of an Existing Business

h. Marketing Activities

____

____

d. Consolidation of Obligations or Non-SBIC Debt Refunding

i. Research and Development

____

____

e. New Building or Plant Construction

j. Other

28. Is this the first Financing of this Small Business by the Licensee? _______

29. Financing Instruments and Applicable Amounts (for participations, include Licensee's portion only):

Instrument

Amount

Initial Interest Rate(s)

% Actual Ownership

Loan Only

$__________

__________%

Debt with Equity Features

$__________

__________%

Equity Only

$__________

__________%

Total Licensee Financing

$__________

30. Total Size of Financing Round for Small Business Concern: _________________________

31. Comments:

Transmission Date _____/_____/_____

Part D - Transmission Verification

SBA Form 1031 (3/14) Previous Editions Obsolete

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2