Form Ct-1120 Sba - Small Business Administration Guaranty Fee Tax Credit - 2015

ADVERTISEMENT

Department of Revenue Services

2015

Form CT-1120 SBA

State of Connecticut

(Rev. 12/15)

Small Business Administration Guaranty Fee Tax Credit

For Income Year Beginning: _______________________ , 2015 and Ending: ________________________ , _________ .

Corporation name

Connecticut Tax Registration Number

Complete this form in blue or black ink only.

The Small Business Administration Guaranty Fee tax credit may no longer be claimed in income years beginning

on or after January 1, 2014. Use Form CT-1120 SBA to apply credits carried forward from prior years. Attach it

to Form CT-1120K, Business Tax Credit Summary.

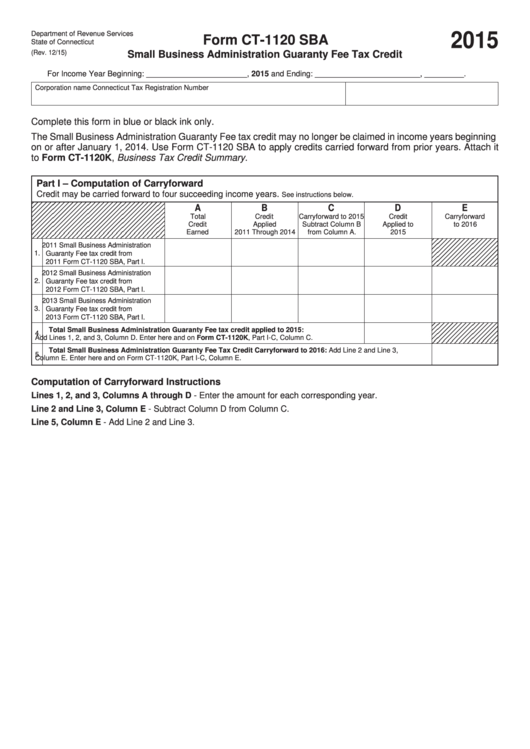

Part I – Computation of Carryforward

Credit may be carried forward to four succeeding income years.

See instructions below.

A

B

C

D

E

Carryforward

Total

Credit

Carryforward to 2015

Credit

Credit

Applied

Subtract Column B

Applied to

to 2016

Earned

2011 Through 2014

from Column A.

2015

2011 Small Business Administration

1.

Guaranty Fee tax credit from

2011 Form CT-1120 SBA, Part I.

2012 Small Business Administration

2.

Guaranty Fee tax credit from

2012 Form CT-1120 SBA, Part I.

2013 Small Business Administration

3.

Guaranty Fee tax credit from

2013 Form CT-1120 SBA, Part I.

Total Small Business Administration Guaranty Fee tax credit applied to 2015:

4.

Add Lines 1, 2, and 3, Column D. Enter here and on Form CT-1120K, Part I-C, Column C.

Total Small Business Administration Guaranty Fee Tax Credit Carryforward to 2016: Add Line 2 and Line 3,

5.

Column E. Enter here and on Form CT-1120K, Part I-C, Column E.

Computation of Carryforward Instructions

Lines 1, 2, and 3, Columns A through D - Enter the amount for each corresponding year.

Line 2 and Line 3, Column E - Subtract Column D from Column C.

Line 5, Column E - Add Line 2 and Line 3.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1