q

q

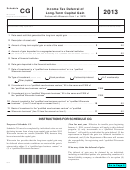

This schedule is

Telefile Form 1 ineligible;

see instructions.

FIRST NAME

M.I.

LAST NAME

SOCIAL SECURITY NUMBER

–

–

Schedule B-1.

Long-Term Capital Gains Tax Credit Applied to 12% Income

1998

Complete only if Schedule B, line 20 is a positive amount and Schedule D, line 17 is a loss.

,

,

1

Enter the amount from Schedule D, line 17 as a positive amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2

Add Schedule B, lines 8, 9, 10, 14, 15 and 16. If line 2 is “0” or less, you are not eligible for this

,

,

credit; omit lines 3–10 and enter “0” in line 11. If line 2 is more than “0” complete lines 3–11 . . . . . . . . 2

,

,

3

Multiply Schedule B, line 20 by .12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

,

,

4

Multiply Schedule B, line 7 by .12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5

Subtract line 4 from line 3. If “0” or less, you are not eligible for this credit; omit lines 6–10 and enter

,

,

“0” in line 11. If line 5 is more than “0,” complete lines 6–11. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6

Divide line 4 by line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

,

,

7

Multiply Schedule B, line 19 by Schedule B-1, line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

,

,

8

Multiply line 7 by .12. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

,

,

9

Multiply the smaller of Schedule C-2, line 7 or line 10 by .12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

,

,

10

Add lines 5, 8 and 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11

Long-term capital gains tax credit applied to 12% income. Enter the smaller of line 1, line 3, line 10

or Form 1, line 24 (less any amount entered in line 25), or Form 1-NR/PY, line 28 (less any amount

entered in line 29) here and on Schedule D, line 18 and include in Schedule Z, line 1 total. Also, fill

,

,

appropriate oval on Schedule Z . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

1

1 2

2