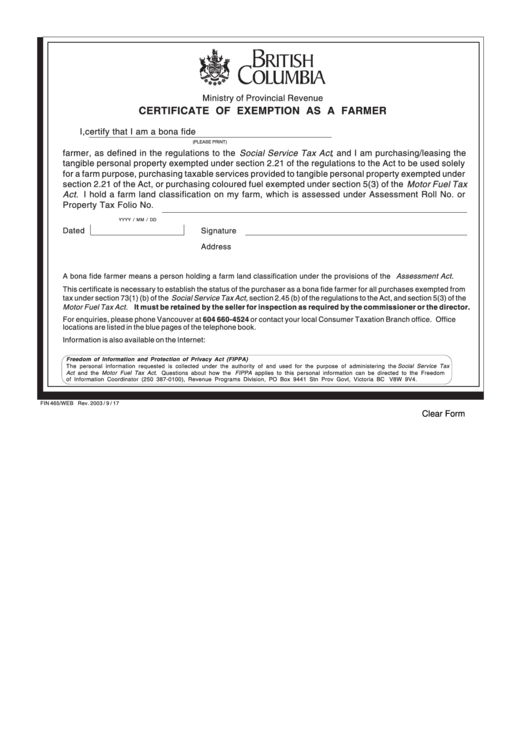

Ministry of Provincial Revenue

CERTIFICATE OF EXEMPTION AS A FARMER

I,

certify that I am a bona fide

(PLEASE PRINT)

farmer, as defined in the regulations to the Social Service Tax Act , and I am purchasing/leasing the

tangible personal property exempted under section 2.21 of the regulations to the Act to be used solely

for a farm purpose, purchasing taxable services provided to tangible personal property exempted under

section 2.21 of the Act, or purchasing coloured fuel exempted under section 5(3) of the Motor Fuel Tax

Act. I hold a farm land classification on my farm, which is assessed under Assessment Roll No. or

Property Tax Folio No.

YYYY / MM / DD

Dated

Signature

Address

A bona fide farmer means a person holding a farm land classification under the provisions of the Assessment Act.

This certificate is necessary to establish the status of the purchaser as a bona fide farmer for all purchases exempted from

tax under section 73(1) (b) of the Social Service Tax Act, section 2.45 (b) of the regulations to the Act, and section 5(3) of the

Motor Fuel Tax Act. It must be retained by the seller for inspection as required by the commissioner or the director.

For enquiries, please phone Vancouver at 604 660-4524 or contact your local Consumer Taxation Branch office. Office

locations are listed in the blue pages of the telephone book.

Information is also available on the Internet:

Freedom of Information and Protection of Privacy Act (FIPPA)

The personal information requested is collected under the authority of and used for the purpose of administering the Social Service Tax

Act and the Motor Fuel Tax Act . Questions about how the FIPPA applies to this personal information can be directed to the Freedom

of Information Coordinator (250 387-0100), Revenue Programs Division, PO Box 9441 Stn Prov Govt, Victoria BC

V8W 9V4.

FIN 465/WEB Rev. 2003 / 9 / 17

Clear Form

1

1