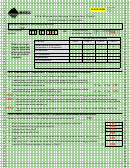

Montana Form Aepc - Alternative Energy Production Credit - 2013 Page 4

ADVERTISEMENT

Part III. Credit Calculation

Line 17 – If you completed:

(This part is to be completed only by partners in a

Part II, enter the smaller of the amount from line 16

●

partnership and shareholders of an S corporation.)

and line 8 from Part II.

In the space provided, enter the business name and Federal

Part III, enter the smaller of the amount from line 16

●

and line 11 from Part III.

Employer Identification Number of the partnership or S

corporation that you are receiving the credit from.

If the amount you calculated on line 16 is larger than the

Line 9 – Enter your portion of the alternative energy

amount on line 8 from Part II or line 11 from Part III (depending

production credit. This amount can be found on the Montana

on which Part you were required to complete), your credit is

Schedule K-1 you received from the entity.

limited in the current year.

Line 10 – Enter any alternative energy production credit that

If the credit is not fully used against your tax liability in the year

you are carrying forward from previous year.

the assets are placed in service, you can carry forward any

unused portion of your tax credit up to seven years. You can

Line 11 – Add lines 9 and 10. This is your total alternative

carry forward up to fifteen years if:

energy production credit before limitation. Continue to Part IV

to determine if there is a limitation on your alternative energy

You invest in a 5 megawatt or larger commercial

●

production credit in 2013.

system located within the exterior boundaries of a

Montana Indian reservation; and

Part IV. Credit Limitation

You sign an employment agreement with the

●

Line 12 – Enter the net income attributable to eligible

tribal government of the reservation where the

alternative energy equipment. For individuals, this amount

commercial system would be constructed regarding

should not include any exemptions or deductions.

the training and employment of tribal members in

the construction, operation and maintenance of the

If a portion of your business’s taxable or net income qualifies

commercial system.

for this credit and a portion does not qualify, you must prorate

your income and associated taxes that qualify for this credit

Income Allocation Worksheet

by using the three-factor formula provided in 15-31-305, MCA.

The Income Allocation Worksheet has been provided at the

Lines 18, 19 and 20 – If you are a C corporation and have

bottom of the form for your convenience.

filed a combined return, the amount you enter in the Total

Factors column should equal the total values from Column A of

Line 13 – Enter your Montana taxable income.

Form CLT-4, Schedule K.

Individuals. Enter the amount from Form 2, line 45; or

Line 23 – Enter the total net income of the business. For C

corporations, enter the amount on line 7 of the CLT-4.

C corporations. Enter the amount from Form CLT-4,

line 7.

Line 24 – Multiply the amount on line 23 by the amount on line

22. This is your net income attributable to eligible alternative

Line 14 – Divide line 12 by line 13. Carry the amount to four

energy equipment. If you are:

decimal places and do not enter more than 1.0000.

An individual, enter this amount on line 12 of Part IV.

●

Line 15 – Enter the total tax from your return.

A C corporation, enter this amount on line 12 of Part

●

Individuals. Enter the amount from Form 2, line 48; or

IV.

C corporations. Enter the amount from Form CLT-4,

An S corporation or partnership, report each owner’s

●

line 10.

distributive share of this amount to them on Montana

Line 16 – Multiply line 14 by line 15 to calculate the maximum

Schedule K-1. Do not complete lines 12 through 17 of

amount of alternative energy production credit you can claim

Part IV.

this year.

Administrative Rules of Montana: 42.4.4101, 42.4.4106,

Your credit is applied only against taxes due as a

42.4.4107, 42.4.4109, 42.4.4112

consequence of taxable or net income produced by one of the

Questions? Please call us toll free at (866) 859-2254 (in

following:

Helena, 444-6900).

a manufacturing plant that is located in Montana

●

and that produces alternative energy generating

equipment;

a new business facility or the expanded portion of

●

an existing business facility for which the alternative

energy generating equipment supplies, on a direct

contract sales basis, the basic energy needed; or

the alternative energy generating equipment in which

●

the investment was made.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4