Instructions For Transaction Privilege (Sales) Tax And Business, Occupational And Profession (Bop) License Application - City Of Glendale, Arizona Tax & License Division

ADVERTISEMENT

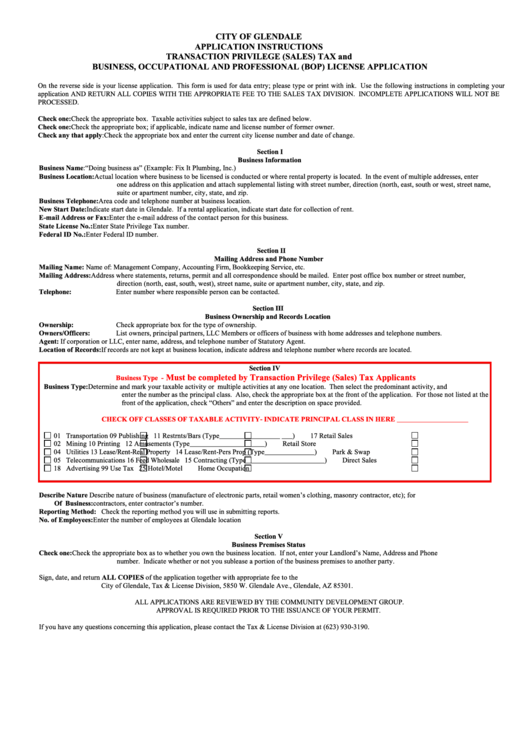

CITY OF GLENDALE

APPLICATION INSTRUCTIONS

TRANSACTION PRIVILEGE (SALES) TAX and

BUSINESS, OCCUPATIONAL AND PROFESSIONAL (BOP) LICENSE APPLICATION

On the reverse side is your license application. This form is used for data entry; please type or print with ink. Use the following instructions in completing your

application AND RETURN ALL COPIES WITH THE APPROPRIATE FEE TO THE SALES TAX DIVISION. INCOMPLETE APPLICATIONS WILL NOT BE

PROCESSED.

Check one:

Check the appropriate box. Taxable activities subject to sales tax are defined below.

Check one:

Check the appropriate box; if applicable, indicate name and license number of former owner.

Check the appropriate box and enter the current city license number and date of change.

Check any that apply:

Section I

Business Information

Business Name:

“Doing business as” (Example: Fix It Plumbing, Inc.)

Actual location where business to be licensed is conducted or where rental property is located. In the event of multiple addresses, enter

Business Location:

one address on this application and attach supplemental listing with street number, direction (north, east, south or west, street name,

suite or apartment number, city, state, and zip.

Business Telephone:

Area code and telephone number at business location.

New Start Date:

Indicate start date in Glendale. If a rental application, indicate start date for collection of rent.

E-mail Address or Fax:

Enter the e-mail address of the contact person for this business.

State License No.:

Enter State Privilege Tax number.

Federal ID No.:

Enter Federal ID number.

Section II

Mailing Address and Phone Number

Mailing Name:

Name of: Management Company, Accounting Firm, Bookkeeping Service, etc.

Mailing Address:

Address where statements, returns, permit and all correspondence should be mailed. Enter post office box number or street number,

direction (north, east, south, west), street name, suite or apartment number, city, state, and zip.

Enter number where responsible person can be contacted.

Telephone:

Section III

Business Ownership and Records Location

Check appropriate box for the type of ownership.

Ownership:

List owners, principal partners, LLC Members or officers of business with home addresses and telephone numbers.

Owners/Officers:

If corporation or LLC, enter name, address, and telephone number of Statutory Agent.

Agent:

Location of Records:

If records are not kept at business location, indicate address and telephone number where records are located.

Section IV

Must be completed by Transaction Privilege (Sales) Tax Applicants

Business Type -

Business Type:

Determine and mark your taxable activity or multiple activities at any one location. Then select the predominant activity, and

enter the number as the principal class. Also, check the appropriate box at the front of the application. For those not listed at the

front of the application, check “Others” and enter the description on space provided.

CHECK OFF CLASSES OF TAXABLE ACTIVITY- INDICATE PRINCIPAL CLASS IN HERE ____________________

01 Transportation

09 Publishing

11 Restrnts/Bars (Type_________________ ___)

17 Retail Sales

02 Mining

10 Printing

12 Amusements (Type_____________________)

Retail Store

04 Utilities

13 Lease/Rent-Real Property

14 Lease/Rent-Pers Prop (Type______________)

Park & Swap

05 Telecommunications

16 Feed Wholesale

15 Contracting (Type______________________)

Direct Sales

18 Advertising

99 Use Tax

25 Hotel/Motel

Home Occupation

Describe Nature

Describe nature of business (manufacture of electronic parts, retail women’s clothing, masonry contractor, etc); for

Of Business:

contractors, enter contractor’s number.

Reporting Method:

Check the reporting method you will use in submitting reports.

Enter the number of employees at Glendale location

No. of Employees:

Section V

Business Premises Status

Check one:

Check the appropriate box as to whether you own the business location. If not, enter your Landlord’s Name, Address and Phone

number. Indicate whether or not you sublease a portion of the business premises to another party.

Sign, date, and return ALL COPIES of the application together with appropriate fee to the

City of Glendale, Tax & License Division, 5850 W. Glendale Ave., Glendale, AZ 85301.

ALL APPLICATIONS ARE REVIEWED BY THE COMMUNITY DEVELOPMENT GROUP.

APPROVAL IS REQUIRED PRIOR TO THE ISSUANCE OF YOUR PERMIT.

If you have any questions concerning this application, please contact the Tax & License Division at (623) 930-3190.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1