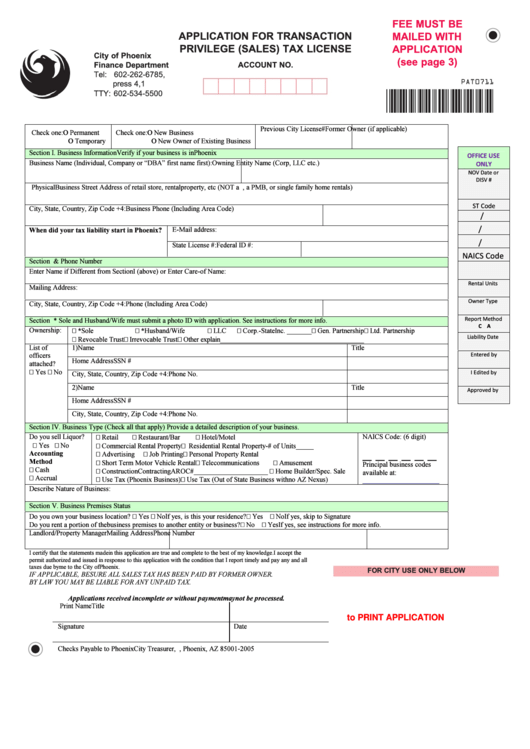

FEE MUST BE

APPLICATION FOR TRANSACTION

MAILED WITH

PRIVILEGE (SALES) TAX LICENSE

APPLICATION

City of Phoenix

(see page 3)

ACCOUNT NO.

Finance Department

Tel: 602-262-6785,

press 4,1

TTY: 602-534-5500

Previous City License #

Former Owner (if applicable)

Check one: Ο Permanent

Check one: Ο New Business

Ο Temporary

Ο New Owner of Existing Business

Section I. Business Information

Verify if your business is in Phoenix

K&&/�� h^�

Business Name (Individual, Company or “DBA” first name first):

Owning Entity Name (Corp, LLC etc.)

KE>z

EKs �

�/^s

Physical Business Street Address of retail store, rental property, etc (NOT a P.O. Box Number, a PMB, or single family home rentals)

^d �

City, State, Country, Zip Code +4:

Business Phone (Including Area Code)

E-Mail address:

When did your tax liability start in Phoenix?

State License #:

Federal ID #:

E /�^ �

Section II. Mailing Address & Phone Number

Enter Name if Different from Section I (above) or Enter Care-of Name:

Z

h

Mailing Address:

K

d

City, State, Country, Zip Code +4:

Phone (Including Area Code)

Z

D

Section III. Business Ownership

* Sole and Husband/Wife must submit a photo ID with application. See instructions for more info.

�

Ownership:

LLC

Corp.-State Inc. _______

Gen. Partnership

Ltd. Partnership

*Sole

*Husband/Wife

>

�

Revocable Trust

Irrevocable Trust

Other explain__________________________________________

List of

1)Name

Title

officers

�

Home Address

SSN #

attached?

Yes

No

/ �

City, State, Country, Zip Code +4:

Phone No.

2)Name

Title

Home Address

SSN #

City, State, Country, Zip Code +4:

Phone No.

Section IV. Business Type (Check all that apply) Provide a detailed description of your business.

Do you sell Liquor?

NAICS Code: (6 digit)

Retail

Restaurant/Bar

Hotel/Motel

Yes

No

Commercial Rental Property

Residential Rental Property-# of Units_____

_ _ _ _ _ _

Accounting

Advertising

Job Printing

Personal Property Rental

Method

Short Term Motor Vehicle Rental

Telecommunications

Amusement

Principal business codes

Cash

Construction Contracting AROC#_____________________

Home Builder/Spec. Sale

available at:

Accrual

Use Tax (Phoenix Business)

Use Tax (Out of State Business with no AZ Nexus)

Describe Nature of Business:

Section V. Business Premises Status

Do you own your business location?

Yes

No

If yes, is this your residence?

Yes

No

If yes, skip to Signature

Do you rent a portion of the business premises to another entity or business?

No

Yes If yes, see instructions for more info.

Landlord/Property Manager

Mailing Address

Phone Number

I certify that the statements made in this application are true and complete to the best of my knowledge. I accept the

permit authorized and issued in response to this application with the condition that I report timely and pay any and all

FOR CITY USE ONLY BELOW

taxes due by me to the City of Phoenix.

IF APPLICABLE, BE SURE ALL SALES TAX HAS BEEN PAID BY FORMER OWNER.

BY LAW YOU MAY BE LIABLE FOR ANY UNPAID TAX.

Applications received incomplete or without payment may not be processed.

Print Name

Title

Click here to PRINT APPLICATION

Signature

Date

Checks Payable to Phoenix City Treasurer, P.O. Box 2005 , Phoenix, AZ 85001-2005

1

1