PRINT

CLEAR

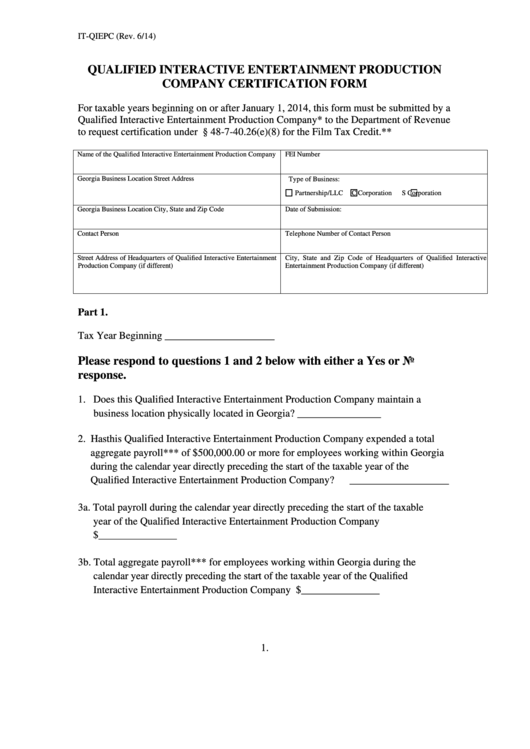

IT-QIEPC (Rev. 6/14)

QUALIFIED INTERACTIVE ENTERTAINMENT PRODUCTION

COMPANY CERTIFICATION FORM

For taxable years beginning on or after January 1, 2014, this form must be submitted by a

Qualified Interactive Entertainment Production Company* to the Department of Revenue

to request certification under O.C.G.A. § 48-7-40.26(e)(8) for the Film Tax Credit.**

Name of the Qualified Interactive Entertainment Production Company

FEI Number

Georgia Business Location Street Address

Type of Business:

Partnership/LLC

C Corporation

S Corporation

Georgia Business Location City, State and Zip Code

Date of Submission:

Contact Person

Telephone Number of Contact Person

Street Address of Headquarters of Qualified Interactive Entertainment

City, State and Zip Code of Headquarters of Qualified Interactive

Production Company (if different)

Entertainment Production Company (if different)

Part 1.

Tax Year Beginning _____________________

Please respond to questions 1 and 2 below with either a Yes or No

response.

1. Does this Qualified Interactive Entertainment Production Company maintain a

business location physically located in Georgia? ________________

2. Has this Qualified Interactive Entertainment Production Company expended a total

aggregate payroll*** of $500,000.00 or more for employees working within Georgia

during the calendar year directly preceding the start of the taxable year of the

Qualified Interactive Entertainment Production Company?

___________________

3a. Total payroll during the calendar year directly preceding the start of the taxable

year of the Qualified Interactive Entertainment Production Company

$_______________

3b. Total aggregate payroll*** for employees working within Georgia during the

calendar year directly preceding the start of the taxable year of the Qualified

Interactive Entertainment Production Company $_______________

1.

1

1 2

2 3

3