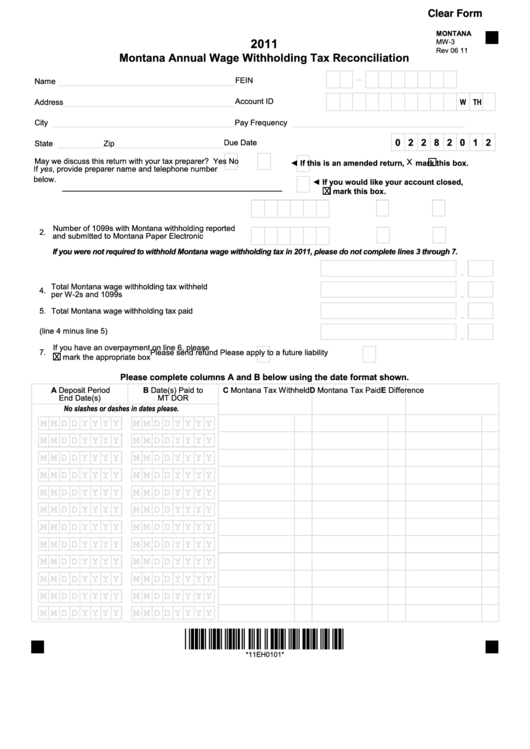

Clear Form

MONTANA

2011

MW-3

Rev 06 11

Montana Annual Wage Withholding Tax Reconciliation

-

_______________________________

FEIN

Name

______________________________

Account ID

W T

H

Address

________________________________

______________________________

City

Pay Frequency

________

___________________

0 2 2 8 2 0 1 2

Due Date

State

Zip

May we discuss this return with your tax preparer?

Yes

No

X

◄ If this is an amended return,

mark this box.

If yes, provide preparer name and telephone number

below.

◄ If you would like your account closed,

__________________________________________

X

mark this box.

1. Number of W-2s submitted to Montana

Paper

Electronic

Number of 1099s with Montana withholding reported

2.

and submitted to Montana

Paper

Electronic

If you were not required to withhold Montana wage withholding tax in 2011, please do not complete lines 3 through 7.

.

3. Total Montana wages paid subject to withholding tax

.

Total Montana wage withholding tax withheld

4.

per W-2s and 1099s

.

5. Total Montana wage withholding tax paid

.

6. Difference (line 4 minus line 5)

If you have an overpayment on line 6, please

7.

Please send refund

Please apply to a future liability

X

mark the appropriate box

Please complete columns A and B below using the date format shown.

A Deposit Period

B Date(s) Paid to

C Montana Tax Withheld

D Montana Tax Paid

E Difference

End Date(s)

MT DOR

No slashes or dashes in dates please.

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

*11EH0101*

*11EH0101*

1

1 2

2