Form Dp-197 - Wholesaler Tobacco Stamp Inventory - Department Of Revenue Administration - 2008 Page 2

ADVERTISEMENT

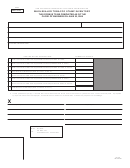

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

DP-197

WHOLESALER TOBACCO STAMP INVENTORY 2008

INSTRUCTIONS

GENERAL INSTRUCTIONS

WHO MUST FILE

LINE BY LINE INSTRUCTIONS

This form is to be completed by WHOLESALERS doing business in New

LINE 1

Enter the number of 20 Pack Cigarette B Tax Stamps Af-

Hampshire.

fi xed to packs in your possession.

"WHOLESALER": any person doing business in this state who purchases

LINE 2

Enter the number of 20 Pack Cigarette B Tax Stamps NOT

unstamped tobacco products directly from a licensed manufacturer, and

Affi xed to packs in your possession.

who sells all tobacco products to licensed wholesalers, sub-jobbers,

vending machine operators, retailers and those persons exempted from

LINE 3

Enter the number of 20 Pack Cigarette B Tax Stamps Af-

the tobacco tax under RSA 78:7-b.

fi xed to packs in transit.

WHEN TO REPORT

LINE 4

Enter the total of B Tax Stamps, the sum of Lines 1, 2 and 3,

on Line 4.

The inventory must be completed as of the close of business, June 30,

LINE 5

Enter the number of 25 Pack Cigarette A Tax Stamps Affi xed

2008. If a DRA representative does not visit your facility by July 15th,

to packs in your possession.

please mail the report no later than JULY 20, 2008 to:

LINE 6

Enter the number of 25 Pack Cigarette A Tax Stamps NOT

NH DRA

Affi xed to packs in your possession.

45 Chenell Drive

PO Box 457

LINE 7

Enter the number of 25 Pack Cigarette A Tax Stamps Affi xed

Concord, NH 03302-0457

to packs in transit.

WHERE TO REPORT

LINE 8

Enter the total of A Tax Stamps, the sum of Lines 5, 6 and 7,

on Line 8.

The Wholesaler Tobacco Stamp Inventory should be hand delivered

to NHDRA (New Hampshire Department of Revenue Administration)

LINE 9

Provide Signatures of taxpayer and paid preparer, in ink,

Personnel during their visit to your facility on July 1, 2008.

where indicated. Print names of taxpayer and paid preparer and their

address, title, date, phone number and e-mail address.

PURPOSE OF INVENTORY AND RETURN

The 2008 Legislative session has resulted in a change to the tobacco tax

rate as of October 1, 2008 with certain sunset provisions. An inventory of

stamps in the possession of Wholesalers is required in order to determine

if the tax increase will sunset.

INVENTORY VERIFICATION

After taking the inventory, record the amounts on the form and complete

this report. You must retain a copy of the inventory records for three

years for possible review by a Department representative, proof of all

transactions that change your inventory and invoices used to determine

values on lines 1 through 8 must be available to the Department's

representative.

QUESTIONS

Specifi c questions relating to this return or the tobacco tax should be

referred to:

NH DRA

45 Chenell Drive, PO Box 457

Concord NH 03302-0457

Telephone: (603) 271-2191

Hearing or speech impaired individuals may call:

TDD Access: Relay NH 1-800-735-2964

DP-197

Instructions

Rev. 06/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2