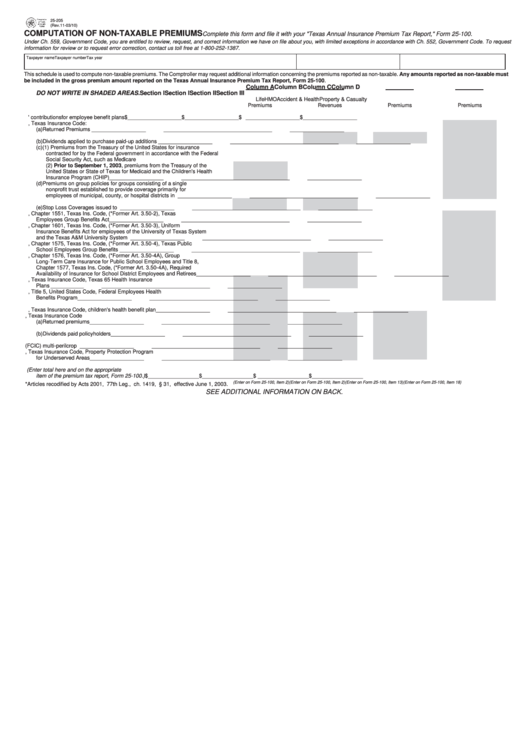

25-205

CLEAR FORM

(Rev.11-03/10)

COMPUTATION OF NON-TAXABLE PREMIUMS

Complete this form and file it with your "Texas Annual Insurance Premium Tax Report," Form 25-100.

Under Ch. 559, Government Code, you are entitled to review, request, and correct information we have on file about you, with limited exceptions in accordance with Ch. 552, Government Code. To request

information for review or to request error correction, contact us toll free at 1-800-252-1387.

Taxpayer name

Taxpayer number

Tax year

This schedule is used to compute non-taxable premiums. The Comptroller may request additional information concerning the premiums reported as non-taxable. Any amounts reported as non-taxable must

be included in the gross premium amount reported on the Texas Annual Insurance Premium Tax Report, Form 25-100.

Column A

Column B

Column C

Column D

DO NOT WRITE IN SHADED AREAS.

Section I

Section I

Section II

Section III

Life

HMO

Accident & Health

Property & Casualty

Premiums

Revenues

Premiums

Premiums

1. Insurers' contributions for employee benefit plans .............................................

$ __________________

$ __________________

$ __________________

$ __________________

2. Article 4.11, Texas Insurance Code:

(a) Returned Premiums .....................................................................................

__________________

__________________

__________________

__________________

(b) Dividends applied to purchase paid-up additions ........................................

__________________

__________________

__________________

__________________

(c) (1) Premiums from the Treasury of the United States for insurance

contracted for by the Federal government in accordance with the Federal

Social Security Act, such as Medicare

(2) Prior to September 1, 2003, premiums from the Treasury of the

United States or State of Texas for Medicaid and the Children's Health

Insurance Program (CHIP) ..........................................................................

__________________

__________________

__________________

__________________

(d) Premiums on group policies for groups consisting of a single

nonprofit trust established to provide coverage primarily for

employees of municipal, county, or hospital districts in Texas ....................

__________________

__________________

__________________

__________________

(e) Stop Loss Coverages issued to HMOs ........................................................

__________________

__________________

__________________

__________________

3. Title 8, Chapter 1551, Texas Ins. Code, (*Former Art. 3.50-2), Texas

Employees Group Benefits Act ..........................................................................

__________________

__________________

__________________

__________________

4. Title 8, Chapter 1601, Texas Ins. Code, (*Former Art. 3.50-3), Uniform

Insurance Benefits Act for employees of the University of Texas System

and the Texas A&M University System ..............................................................

__________________

__________________

__________________

__________________

5. Title 8, Chapter 1575, Texas Ins. Code, (*Former Art. 3.50-4), Texas Public

School Employees Group Benefits Program ......................................................

__________________

__________________

__________________

__________________

6. Title 8, Chapter 1576, Texas Ins. Code, (*Former Art. 3.50-4A), Group

Long-Term Care Insurance for Public School Employees and Title 8,

Chapter 1577, Texas Ins. Code, (*Former Art. 3.50-4A), Required

Availability of Insurance for School District Employees and Retirees ................

__________________

__________________

__________________

__________________

7. Article 3.71, Texas Insurance Code, Texas 65 Health Insurance

Plans ...................................................................................................................

__________________

__________________

__________________

__________________

8. Section 8909, Title 5, United States Code, Federal Employees Health

Benefits Program ................................................................................................

__________________

__________________

__________________

__________________

9. Article 27.05, Texas Insurance Code, children's health benefit plan .................

__________________

__________________

__________________

__________________

10. Article 4.10, Texas Insurance Code

(a) Returned premiums .....................................................................................

__________________

__________________

__________________

__________________

(b) Dividends paid policyholders .......................................................................

__________________

__________________

__________________

__________________

11. Federal Crop Insurance Corporation (FCIC) multi-peril crop preemption ..........

__________________

__________________

__________________

__________________

12. Article 5.35-3, Texas Insurance Code, Property Protection Program

for Underserved Areas .......................................................................................

__________________

__________________

__________________

__________________

13. Total Non-taxable Premiums (Enter total here and on the appropriate

item of the premium tax report, Form 25-100.) ...................................................

$ _________________

$ _________________

$ _________________

$ _________________

(Enter on Form 25-100, Item 2)

(Enter on Form 25-100, Item 2)

(Enter on Form 25-100, Item 13)

(Enter on Form 25-100, Item 18)

*Articles recodified by Acts 2001, 77th Leg., ch. 1419, § 31, effective June 1, 2003.

SEE ADDITIONAL INFORMATION ON BACK.

1

1 2

2