PRINT FORM

CLEAR FORM

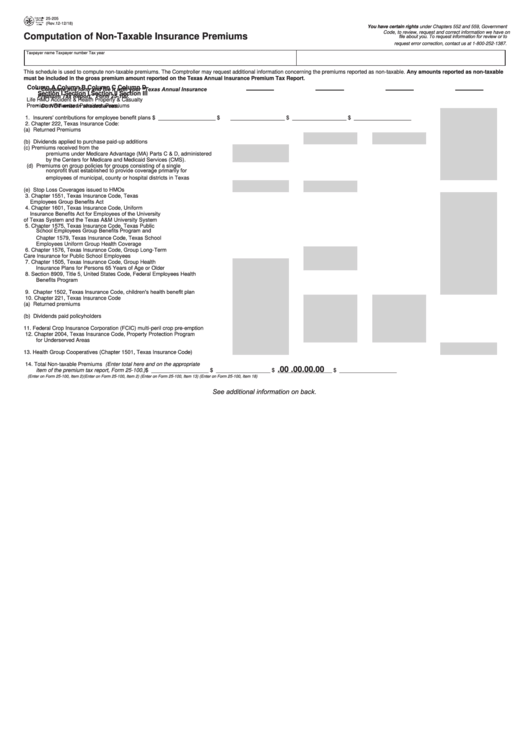

25-205

(Rev.12-12/18)

You have certain rights under Chapters 552 and 559, Government

Code, to review, request and correct information we have on

Computation of Non-Taxable Insurance Premiums

file about you. To request information for review or to

request error correction, contact us at 1-800-252-1387.

Taxpayer name

Taxpayer number

Tax year

This schedule is used to compute non-taxable premiums. The Comptroller may request additional information concerning the premiums reported as non-taxable. Any amounts reported as non-taxable

must be included in the gross premium amount reported on the Texas Annual Insurance Premium Tax Report.

•

Column A

Column B

Column C

Column D

Complete this form and file it with your "Texas Annual Insurance

Section I

Section I

Section II

Section III

Premium Tax Report," Form 25-100.

Life

HMO

Accident & Health

Property & Casualty

•

Do NOT write in shaded areas.

Premiums

Revenues

Premiums

Premiums

1. Insurers' contributions for employee benefit plans ............................................

$ ___________________

$ __________________

$ __________________

$ ___________________

2. Chapter 222, Texas Insurance Code:

(a) Returned Premiums ....................................................................................

___________________

__________________

__________________

___________________

(b) Dividends applied to purchase paid-up additions ........................................

___________________

__________________

__________________

___________________

(c) Premiums received from the U.S. Treasury for Medicare insurance and

premiums under Medicare Advantage (MA) Parts C & D, administered

by the Centers for Medicare and Medicaid Services (CMS). .......................

___________________

__________________

__________________

___________________

(d) Premiums on group policies for groups consisting of a single

nonprofit trust established to provide coverage primarily for

employees of municipal, county or hospital districts in Texas ......................

___________________

__________________

__________________

___________________

(e) Stop Loss Coverages issued to HMOs ........................................................

___________________

__________________

__________________

___________________

3. Chapter 1551, Texas Insurance Code, Texas

Employees Group Benefits Act ...........................................................................

___________________

__________________

__________________

___________________

4. Chapter 1601, Texas Insurance Code, Uniform

Insurance Benefits Act for Employees of the University

of Texas System and the Texas A&M University System ...................................

___________________

__________________

__________________

___________________

5. Chapter 1575, Texas Insurance Code, Texas Public

School Employees Group Benefits Program and

Chapter 1579, Texas Insurance Code, Texas School

Employees Uniform Group Health Coverage ...................................................

___________________

__________________

__________________

___________________

6. Chapter 1576, Texas Insurance Code, Group Long-Term

Care Insurance for Public School Employees ...................................................

___________________

__________________

__________________

___________________

7. Chapter 1505, Texas Insurance Code, Group Health

Insurance Plans for Persons 65 Years of Age or Older ......................................

___________________

__________________

__________________

___________________

8. Section 8909, Title 5, United States Code, Federal Employees Health

Benefits Program ................................................................................................

___________________

__________________

__________________

___________________

9. Chapter 1502, Texas Insurance Code, children's health benefit plan ...............

___________________

__________________

__________________

___________________

10. Chapter 221, Texas Insurance Code

(a) Returned premiums .....................................................................................

___________________

__________________

__________________

___________________

(b) Dividends paid policyholders .......................................................................

___________________

__________________

__________________

___________________

11. Federal Crop Insurance Corporation (FCIC) multi-peril crop pre-emption .........

___________________

__________________

__________________

___________________

12. Chapter 2004, Texas Insurance Code, Property Protection Program

for Underserved Areas .......................................................................................

___________________

__________________

__________________

___________________

13. Health Group Cooperatives (Chapter 1501, Texas Insurance Code) .................

___________________

__________________

__________________

___________________

14. Total Non-taxable Premiums (Enter total here and on the appropriate

.00

.00

.00

.00

item of the premium tax report, Form 25-100.) ..................................................

$ ___________________

$ __________________

$ __________________

$ ___________________

(Enter on Form 25-100, Item 2)

(Enter on Form 25-100, Item 2)

(Enter on Form 25-100, Item 13)

(Enter on Form 25-100, Item 18)

See additional information on back.

1

1 2

2