Form 1040s-Me Draft - Maine Individual Income Tax Resident Short Form Page 2

ADVERTISEMENT

*020220100*

1040S-ME RESIDENT SHORT FORM

Page 2

*020220100*

.

,

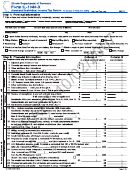

20 INCOME TAX (From line 19, page 1) ............................................................................................................ 20

21 LOW-INCOME CREDIT If the amount on line 18 is $2,000 or less and neither you nor your spouse

.

(if married) are claimed on another person’s return, enter the amount on line 20 here ............................................... 21

NOTE: You are not required to file a return if you qualify for this credit. (See instructions)

.

,

22 EARNED INCOME TAX CREDIT (EIC) Your federal EIC $ _______________ x .05. Enter result here ....... 22

.

,

23 NET INCOME TAX Line 20 minus lines 21 and 22 (If less than zero, enter zero) ...................................... 23

STEP 5

.

,

Calculate Your

24 MAINE INCOME TAX WITHHELD (Enclose W-2 and 1099 forms) ..........................................................

24

è

Tax and

(DO NOT include estimated tax payments)

Voluntary

.

,

Contributions

25 OVERPAYMENT If line 24 is larger than line 23, subtract line 23 from line 24. Enter result here .............. 25

.

,

26 UNDERPAYMENT If line 23 is larger than line 24, subtract line 24 from line 23. Enter result here ........... 26

.

,

27 TOTAL VOLUNTARY CONTRIBUTIONS AND PARK PASS PURCHASES (From Schedule CP, line 10) ...... 27

.

,

28 USE TAX (SALES TAX) (See instructions) ................................................................................................... 28

29 REFUND (Line 25 minus lines 27 and 28). – NOTE: If total of lines 27 and 28 is greater than line

J

.

,

25, subtract line 25 from lines 27 and 28 and enter the amount on line 31 below. ...................................... 29

IF YOU WOULD LIKE YOUR REFUND DEPOSITED DIRECTLY TO YOUR BANK ACCOUNT ($5,000 or less) OR TO YOUR NEXTGEN COLLEGE

®

INVESTING PLAN

ACCOUNT, read the instructions on page 8, and fill out the information below. NOTE: Completing the information below

STEP 6

authorizes Maine Revenue Services to disclose your social security number listed on the front of this form to your financial institution for the sole

®

purpose of depositing your income tax refund directly into your bank account or NextGen College Investing Plan

Account.

Calculate Your

Refund or

Amount Due

30a Routing Number

30c Account type

Checking

Direct

30

Savings

Deposit

30b Account Number

NextGen

AMOUNT DUE

31

Line 26 plus lines 27 and 28. (OR If total of lines 27 and 28 is greater than line 25,

.

,

subtract line 25 from the total of lines 27 and 28). (If $1,000 or more see instructions.) Enter result here. .... 31

ENCLOSE CHECK payable to: Treasurer, State of Maine. Include your social security number on your check to receive proper credit on

your account. DO NOT SEND CASH.

FOR MAINE RESIDENTS ONLY: If you would like to receive a 2003 Maine Residents Property Tax and Rent Refund Application Check here: ............. è

The Maine Residents Property Tax and Rent Refund program is a property tax relief program for qualified homeowners or renters who live in Maine. The 2002 program was

generally available to Maine residents with household income less than $45,100 for multi-member households or less than $29,100 for single-member households. Also, your

property taxes must have been greater than 4% of your income or your rent must have been greater than 22% of your income. Under current law, you may apply for this refund anytime from

August 1, 2003 through December 31, 2003. THE APPLICATION WILL BE MAILED TO YOU IN AUGUST 2003 unless the income on line 15 is greater than the income limits for the program.

To reduce state printing and postage costs, if you have your return done by a tax preparer and do not need Maine income tax forms and instructions mailed to

you next year, check box at right ...................................................................................................................................................................................................

è.

(Month)

(Day)

(Year)

(Month)

(Day)

(Year)

If taxpayer is deceased,

If spouse is deceased,

IMPORTANT NOTE

/

/

/

/

enter date of death.

enter date of death.

Do you want to allow another person to discuss this return with Maine Revenue Services?

Yes (complete the following).

No.

Third Party

Designee

Designee’s name _________________________

Phone no. (

) ___________________

Personal identification number

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and

belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

________________________________________

_____________________________

________________________________________________

YOUR SIGNATURE

DATE

YOUR OCCUPATION

Sign Here

________________________________________

_____________________________

________________________________________________

Keep a copy

SPOUSE’S SIGNATURE

DATE

SPOUSE’S OCCUPATION

of this return

for your

records

__________________________________________

_______________________

__________________________________________

PREPARER’S SIGNATURE

DATE

PREPARER’S PHONE NUMBER

Paid

Preparer’s

___________________________________________________________________________

use only

PRINT PREPARER’S NAME and NAME OF BUSINESS

PREPARER’S EIN or PTIN

If requesting a REFUND, mail to: Maine Revenue Services, P.O. Box 9110, Augusta, ME 04332-9110

OFFICE USE

CK $ __________

If NOT requesting a refund, mail to: Maine Revenue Services, P.O. Box 1066, Augusta, ME 04332-1066

PP

IS

ONLY:

DO NOT SEND PHOTOCOPIES OF RETURNS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3