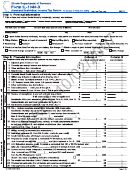

Form 1040s-Me Draft - Maine Individual Income Tax Resident Short Form Page 3

ADVERTISEMENT

Your Social Security Number

Name(s) as shown on Form 1040S-ME

-

-

2002 - Worksheet for Pension Income Deduction - Form 1040S-ME, Line 14

Enclose with your Form 1040S-ME

WORKSHEET for PENSION INCOME DEDUCTION. You and your spouse (if married) may each deduct up to $6,000 of eligible

pension

income*

that is included in your federal adjusted gross income. Except for military pension benefits, the $6,000 cap must be

reduced by any social security and railroad retirement benefits received, whether taxable or not. Deductible pension income includes

state, federal, and military pension benefits as well as retirement benefits received from plans established and maintained by an

employer for the benefit of its employees under Sections 401(a) (Qualified Pension Plans, including qualified SIMPLE plans), 403

(Employee annuities), and 457(b) (State and local government/tax exempt organizations/eligible deferred compensation plans) of the

Internal Revenue Code (IRC). Pension benefits received from an individual retirement account (including SIMPLE retirement accounts),

simplified employee pension plan, benefits from an ineligible deferred compensation plan, premature lump-sum distributions subject

to the special federal tax on lump-sum distributions, and refunds of excess contributions do not qualify for the deduction. Also,

disability benefits reported as wages do not qualify.

*Except in the case of a surviving spouse, eligible pension income does not include benefits earned by another person. Only

the individual that earned the benefit from prior employment may claim the pension income for the deduction. However, a

widowed spouse receiving survivor’s benefits under an eligible pension plan may claim that amount for purposes of this

deduction, but the total pension deduction for the surviving spouse may not exceed $6,000.

NOTE: Enter eligible non-military pension benefits on line 1 and eligible military pension benefits on line 6.

1. Total eligible non-military pension income (both Maine and non-Maine sources) included in your federal

Taxpayer

Spouse*

adjusted gross income (from federal form 1040A, line 12b or Form 1040, line 16b). (Do not include social

security or railroad retirement benefits received or pension benefits received from an individual retirement

account, simplified employee pension plan, an ineligible deferred compensation plan, premature lump-sum

1. $

$

distributions subject to the special federal tax on lump-sum distributions, or refunds of excess contributions).

2. Maximum allowable deduction

2. $

6,000.00

$

6,000.00

3. Total social security and railroad retirement benefits you received - whether taxable or not

3. $

$

4. Subtract line 3 from line 2 (If zero or less, enter zero)

4. $

$

5. Enter the smaller of line 1 or line 4 here

5. $

$

6. Total eligible military pension income

6. $

$

7. Add line 5 and line 6

7. $

$

8. Enter the smaller of line 2 or line 7 here and the total for both spouses on line 14 (Form 1040S-ME)

8. $

$

or line 15 of the Telefile Worksheet

*Use this column only if filing a married-joint return and only if spouse separately earned an eligible pension.

14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3