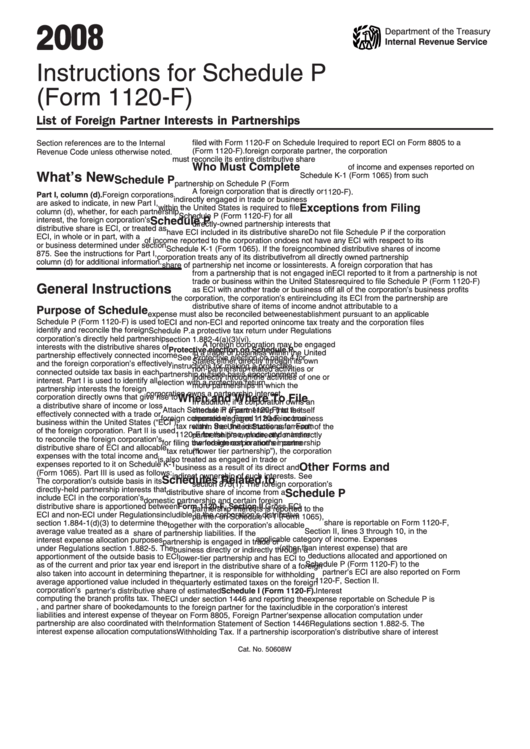

Instructions For Schedule P (Form 1120-F) - 2008

ADVERTISEMENT

2 0 08

Department of the Treasury

Internal Revenue Service

Instructions for Schedule P

(Form 1120-F)

List of Foreign Partner Interests in Partnerships

filed with Form 1120-F on Schedule I

required to report ECI on Form 8805 to a

Section references are to the Internal

(Form 1120-F).

foreign corporate partner, the corporation

Revenue Code unless otherwise noted.

must reconcile its entire distributive share

Who Must Complete

of income and expenses reported on

What’s New

Schedule K-1 (Form 1065) from such

Schedule P

partnership on Schedule P (Form

A foreign corporation that is directly or

1120-F).

Part I, column (d). Foreign corporations

indirectly engaged in trade or business

are asked to indicate, in new Part I,

Exceptions from Filing

within the United States is required to file

column (d), whether, for each partnership

Schedule P (Form 1120-F) for all

Schedule P

interest, the foreign corporation’s

directly-owned partnership interests that

distributive share is ECI, or treated as

have ECI included in its distributive share

Do not file Schedule P if the corporation

ECI, in whole or in part, with a U.S. trade

of income reported to the corporation on

does not have any ECI with respect to its

or business determined under section

Schedule K-1 (Form 1065). If the foreign

combined distributive shares of income

875. See the instructions for Part I,

corporation treats any of its distributive

from all directly owned partnership

column (d) for additional information.

share of partnership net income or loss

interests. A foreign corporation that has

from a partnership that is not engaged in

ECI reported to it from a partnership is not

trade or business within the United States

required to file Schedule P (Form 1120-F)

General Instructions

as ECI with another trade or business of

if all of the corporation’s business profits

the corporation, the corporation’s entire

including its ECI from the partnership are

distributive share of items of income and

not attributable to a U.S. permanent

Purpose of Schedule

expense must also be reconciled between

establishment pursuant to an applicable

Schedule P (Form 1120-F) is used to

ECI and non-ECI and reported on

income tax treaty and the corporation files

identify and reconcile the foreign

Schedule P.

a protective tax return under Regulations

corporation’s directly held partnership

section 1.882-4(a)(3)(vi).

A foreign corporation may be engaged

interests with the distributive shares of

Protective election on Schedule P.

in a trade or business within the United

partnership effectively connected income

See Protective election on page 4 for

States either directly through its own

and the foreign corporation’s effectively

instructions for making a protective

non-partnership related activities or

connected outside tax basis in each

partnership outside basis apportionment

indirectly through the activities of one or

interest. Part I is used to identify all

election with a protective return.

more partnerships in which the

partnership interests the foreign

corporation owns a partnership interest.

corporation directly owns that give rise to

When and Where To File

In addition, if a corporation owns an

a distributive share of income or loss

interest in a partnership that is itself

Attach Schedule P (Form 1120-F) to the

effectively connected with a trade or

deemed engaged in trade or business

foreign corporation’s Form 1120-F income

business within the United States (“ECI”)

within the United States as a result of the

tax return. See the instructions for Form

of the foreign corporation. Part II is used

partnership’s own directly or indirectly

1120-F for the time, place, and manner

to reconcile the foreign corporation’s

owned interest in another partnership

for filing the foreign corporation’s income

distributive share of ECI and allocable

(“lower tier partnership”), the corporation

tax return.

expenses with the total income and

is also treated as engaged in trade or

expenses reported to it on Schedule K-1

Other Forms and

business as a result of its direct and

(Form 1065). Part III is used as follows:

indirect ownership of such interests. See

Schedules Related to

The corporation’s outside basis in its

section 875(1). The foreign corporation’s

directly-held partnership interests that

Schedule P

distributive share of income from a

include ECI in the corporation’s

domestic partnership and certain foreign

distributive share is apportioned between

Form 1120-F, Section II. Gross ECI

partnership interests is reported to the

ECI and non-ECI under Regulations

includible in the corporation’s distributive

partner on Schedule K-1 (Form 1065),

share is reportable on Form 1120-F,

section 1.884-1(d)(3) to determine the

together with the corporation’s allocable

Section II, lines 3 through 10, in the

average value treated as a U.S. asset for

share of partnership liabilities. If the

applicable category of income. Expenses

interest expense allocation purposes

partnership is engaged in trade or

(other than interest expense) that are

under Regulations section 1.882-5. The

business directly or indirectly through a

deductions allocated and apportioned on

apportionment of the outside basis to ECI

lower-tier partnership and has ECI to

Schedule P (Form 1120-F) to the

as of the current and prior tax year end is

report in the distributive share of a foreign

partner’s ECI are also reported on Form

also taken into account in determining the

partner, it is responsible for withholding

1120-F, Section II.

average apportioned value included in the

quarterly estimated taxes on the foreign

corporation’s U.S. assets for purposes of

partner’s distributive share of estimated

Schedule I (Form 1120-F). Interest

computing the branch profits tax. The

ECI under section 1446 and reporting the

expense reportable on Schedule P is

U.S. assets, and partner share of booked

amounts to the foreign partner for the tax

includible in the corporation’s interest

liabilities and interest expense of the

year on Form 8805, Foreign Partner’s

expense allocation computation under

partnership are also coordinated with the

Information Statement of Section 1446

Regulations section 1.882-5. The

interest expense allocation computations

Withholding Tax. If a partnership is

corporation’s distributive share of interest

Cat. No. 50608W

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4