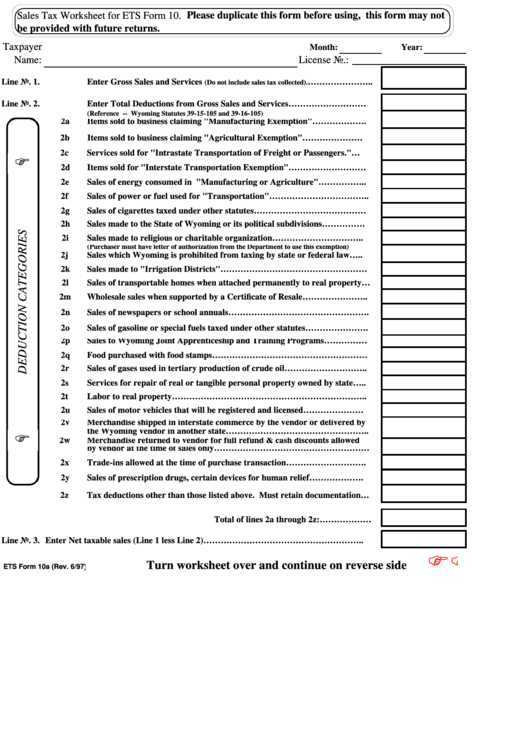

Sales Tax Worksheet For Ets Form 10

ADVERTISEMENT

Sales Tax Worksheet for ETS Form 10. Please duplicate this form before using, this form may not

be provided with future returns.

Taxpayer

Month:

Year:

Name:

License No.:

Line No. 1.

Enter Gross Sales and Services

…………………..

(Do not include sales tax collected).

Line No. 2.

Enter Total Deductions from Gross Sales and Services………………………

(Reference -- Wyoming Statutes 39-15-105 and 39-16-105)

2a

Items sold to business claiming "Manufacturing Exemption"……………….

2b

Items sold to business claiming "Agricultural Exemption"…………………

2c

Services sold for "Intrastate Transportation of Freight or Passengers."…

F

2d

Items sold for "Interstate Transportation Exemption"………………………

2e

Sales of energy consumed in "Manufacturing or Agriculture"……………..

2f

Sales of power or fuel used for "Transportation"……………………………..

2g

Sales of cigarettes taxed under other statutes…………………………………

2h

Sales made to the State of Wyoming or its political subdivisions……………

2i

Sales made to religious or charitable organization…………………………..

(Purchaser must have letter of authorization from the Department to use this exemption)

2j

Sales which Wyoming is prohibited from taxing by state or federal law…..

2k

Sales made to "Irrigation Districts"……………………………………………

2l

Sales of transportable homes when attached permanently to real property…

2m

Wholesale sales when supported by a Certificate of Resale…………………..

2n

Sales of newspapers or school annuals………………………………………….

2o

Sales of gasoline or special fuels taxed under other statutes………………….

2p

Sales to Wyoming Joint Apprenticeship and Training Programs……………

2q

Food purchased with food stamps………………………………………………

2r

Sales of gases used in tertiary production of crude oil………………………..

2s

Services for repair of real or tangible personal property owned by state…..

2t

Labor to real property…………………………………………………………..

2u

Sales of motor vehicles that will be registered and licensed…………………

2v

Merchandise shipped in interstate commerce by the vendor or delivered by

the Wyoming vendor in another state…………………………………………..

F

2w

Merchandise returned to vendor for full refund & cash discounts allowed

by vendor at the time of sales only………………………………………………

2x

Trade-ins allowed at the time of purchase transaction……………………….

2y

Sales of prescription drugs, certain devices for human relief……………….

2z

Tax deductions other than those listed above. Must retain documentation…

Total of lines 2a through 2z:………………

Line No. 3. Enter Net taxable sales (Line 1 less Line 2)………………………………………………..

F F

Turn worksheet over and continue on reverse side

ETS Form 10a (Rev. 6/97)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2