Form Dr 0100a - Retail Sales Tax Return For Occasional Sales

ADVERTISEMENT

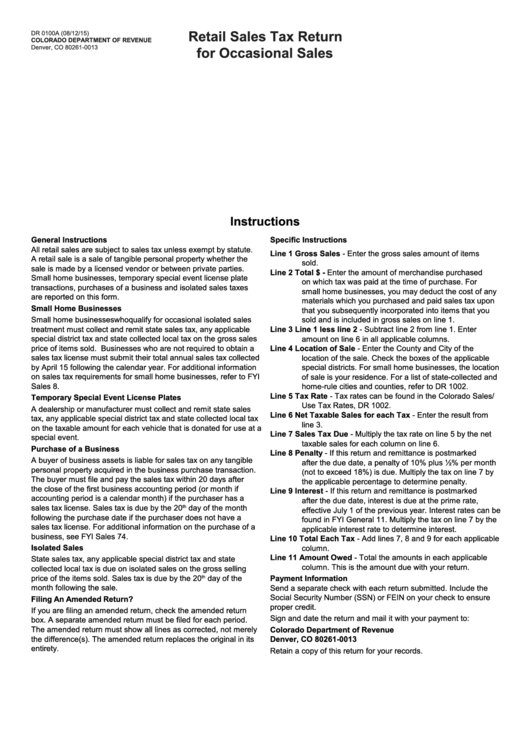

Retail Sales Tax Return

DR 0100A (08/12/15)

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0013

for Occasional Sales

Instructions

General Instructions

Specific Instructions

All retail sales are subject to sales tax unless exempt by statute.

Line 1

Gross Sales - Enter the gross sales amount of items

A retail sale is a sale of tangible personal property whether the

sold.

sale is made by a licensed vendor or between private parties.

Line 2

Total $ - Enter the amount of merchandise purchased

Small home businesses, temporary special event license plate

on which tax was paid at the time of purchase. For

transactions, purchases of a business and isolated sales taxes

small home businesses, you may deduct the cost of any

are reported on this form.

materials which you purchased and paid sales tax upon

Small Home Businesses

that you subsequently incorporated into items that you

Small home businesses who qualify for occasional isolated sales

sold and is included in gross sales on line 1.

treatment must collect and remit state sales tax, any applicable

Line 3

Line 1 less line 2 - Subtract line 2 from line 1. Enter

special district tax and state collected local tax on the gross sales

amount on line 6 in all applicable columns.

price of items sold. Businesses who are not required to obtain a

Line 4

Location of Sale - Enter the County and City of the

sales tax license must submit their total annual sales tax collected

location of the sale. Check the boxes of the applicable

by April 15 following the calendar year. For additional information

special districts. For small home businesses, the location

on sales tax requirements for small home businesses, refer to FYI

of sale is your residence. For a list of state-collected and

Sales 8.

home-rule cities and counties, refer to DR 1002.

Line 5

Tax Rate - Tax rates can be found in the Colorado Sales/

Temporary Special Event License Plates

Use Tax Rates, DR 1002.

A dealership or manufacturer must collect and remit state sales

Line 6

Net Taxable Sales for each Tax - Enter the result from

tax, any applicable special district tax and state collected local tax

line 3.

on the taxable amount for each vehicle that is donated for use at a

Line 7

Sales Tax Due - Multiply the tax rate on line 5 by the net

special event.

taxable sales for each column on line 6.

Purchase of a Business

Line 8

Penalty - If this return and remittance is postmarked

A buyer of business assets is liable for sales tax on any tangible

after the due date, a penalty of 10% plus ½% per month

personal property acquired in the business purchase transaction.

(not to exceed 18%) is due. Multiply the tax on line 7 by

The buyer must file and pay the sales tax within 20 days after

the applicable percentage to determine penalty.

the close of the first business accounting period (or month if

Line 9

Interest - If this return and remittance is postmarked

accounting period is a calendar month) if the purchaser has a

after the due date, interest is due at the prime rate,

sales tax license. Sales tax is due by the 20

day of the month

th

effective July 1 of the previous year. Interest rates can be

following the purchase date if the purchaser does not have a

found in FYI General 11. Multiply the tax on line 7 by the

sales tax license. For additional information on the purchase of a

applicable interest rate to determine interest.

business, see FYI Sales 74.

Line 10 Total Each Tax - Add lines 7, 8 and 9 for each applicable

Isolated Sales

column.

Line 11 Amount Owed - Total the amounts in each applicable

State sales tax, any applicable special district tax and state

column. This is the amount due with your return.

collected local tax is due on isolated sales on the gross selling

price of the items sold. Sales tax is due by the 20

day of the

Payment Information

th

month following the sale.

Send a separate check with each return submitted. Include the

Social Security Number (SSN) or FEIN on your check to ensure

Filing An Amended Return?

proper credit.

If you are filing an amended return, check the amended return

Sign and date the return and mail it with your payment to:

box. A separate amended return must be filed for each period.

The amended return must show all lines as corrected, not merely

Colorado Department of Revenue

the difference(s). The amended return replaces the original in its

Denver, CO 80261-0013

entirety.

Retain a copy of this return for your records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2