Form Eqr - Income Tax Withheld From Wages

ADVERTISEMENT

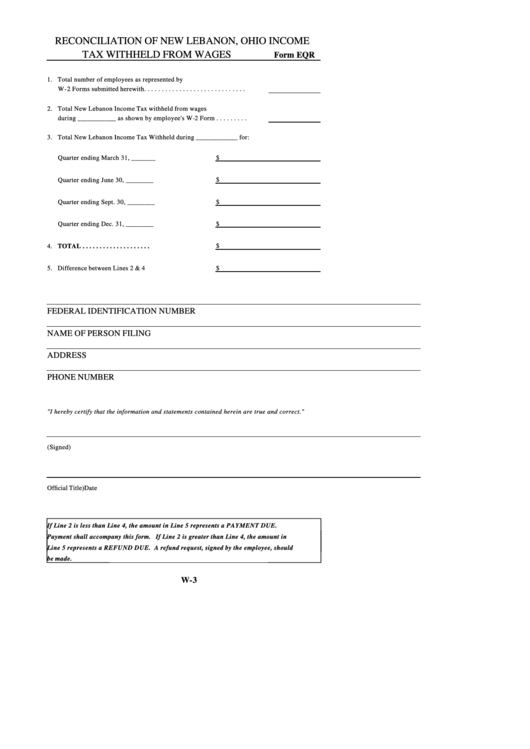

RECONCILIATION OF NEW LEBANON, OHIO INCOME

TAX WITHHELD FROM WAGES

Form EQR

1. Total number of employees as represented by

W-2 Forms submitted herewith. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Total New Lebanon Income Tax withheld from wages

during ___________ as shown by employee's W -2 Form . . . . . . . . .

3. Total New Lebanon Income Tax Withheld during ____________ for:

Quarter ending March 31, _______

$

Quarter ending June 30, ________

$

Quarter ending Sept. 30, ________

$

Quarter ending Dec. 31, ________

$

4. TOTAL . . . . . . . . . . . . . . . . . . . .

$

5. Difference between Lines 2 & 4

$

FEDERAL IDENTIFICATION NUMBER

NAME OF PERSON FILING

ADDRESS

PHONE NUMBER

"I hereby certify that the information and statements contained herein are true and correct."

(Signed)

Official Title)

Date

If Line 2 is less than Line 4, the amount in Line 5 represents a PAYMENT DUE.

Payment shall accompany this form. If Line 2 is greater than Line 4, the amount in

Line 5 represents a REFUND DUE. A refund request, signed by the employee, should

be made.

W-3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1