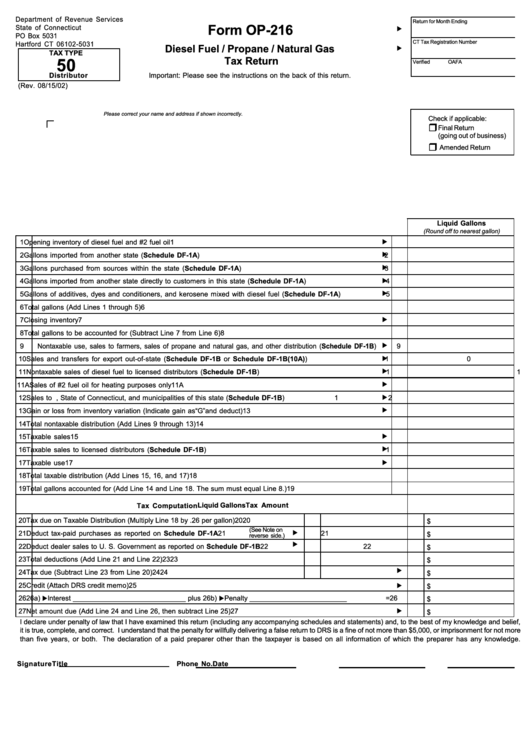

Form Op-216 - Diesel Fuel / Propane / Natural Gas Tax Return

ADVERTISEMENT

Department of Revenue Services

Return for Month Ending

Form OP-216

State of Connecticut

PO Box 5031

CT Tax Registration Number

Hartford CT 06102-5031

Diesel Fuel / Propane / Natural Gas

TAX TYPE

Tax Return

50

Verified

OA

FA

Distributor

Important: Please see the instructions on the back of this return.

(Rev. 08/15/02)

Please correct your name and address if shown incorrectly.

Check if applicable:

Final Return

(going out of business)

Amended Return

Liquid Gallons

(Round off to nearest gallon)

1

Opening inventory of diesel fuel and #2 fuel oil

1

2

Gallons imported from another state (Schedule DF-1A)

2

3

Gallons purchased from sources within the state (Schedule DF-1A)

3

4

Gallons imported from another state directly to customers in this state (Schedule DF-1A)

4

5

Gallons of additives, dyes and conditioners, and kerosene mixed with diesel fuel (Schedule DF-1A)

5

6

Total gallons (Add Lines 1 through 5)

6

7

Closing inventory

7

8

Total gallons to be accounted for (Subtract Line 7 from Line 6)

8

9

Nontaxable use, sales to farmers, sales of propane and natural gas, and other distribution (Schedule DF-1B)

9

10

Sales and transfers for export out-of-state (Schedule DF-1B or Schedule DF-1B(10A))

10

11

Nontaxable sales of diesel fuel to licensed distributors (Schedule DF-1B)

11

11A

Sales of #2 fuel oil for heating purposes only

11A

12

Sales to U.S. Government, State of Connecticut, and municipalities of this state (Schedule DF-1B)

12

13

Gain or loss from inventory variation (Indicate gain as “G” and deduct)

13

14

Total nontaxable distribution (Add Lines 9 through 13)

14

15

Taxable sales

15

16

Taxable sales to licensed distributors (Schedule DF-1B)

16

17

Taxable use

17

18

Total taxable distribution (Add Lines 15, 16, and 17)

18

19

Total gallons accounted for (Add Line 14 and Line 18. The sum must equal Line 8.)

19

Liquid Gallons

Tax Amount

Tax Computation

20

Tax due on Taxable Distribution (Multiply Line 18 by .26 per gallon)

20

20

$

(See Note on

21

Deduct tax-paid purchases as reported on Schedule DF-1A

21

21

$

reverse side.)

22

Deduct dealer sales to U. S. Government as reported on Schedule DF-1B

22

22

$

23

Total deductions (Add Line 21 and Line 22)

23

23

$

24

Tax due (Subtract Line 23 from Line 20)

24

24

$

25

Credit (Attach DRS credit memo)

25

$

26

26a)

Interest _____________________________ plus 26b)

Penalty _________________________

=

26

$

27

Net amount due (Add Line 24 and Line 26, then subtract Line 25)

27

$

I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief,

it is true, complete, and correct. I understand that the penalty for willfully delivering a false return to DRS is a fine of not more than $5,000, or imprisonment for not more

than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Signature

Title

Phone No.

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1