Form 54-008 - Application For Speculative Shell Buildings Property Tax Exemption

ADVERTISEMENT

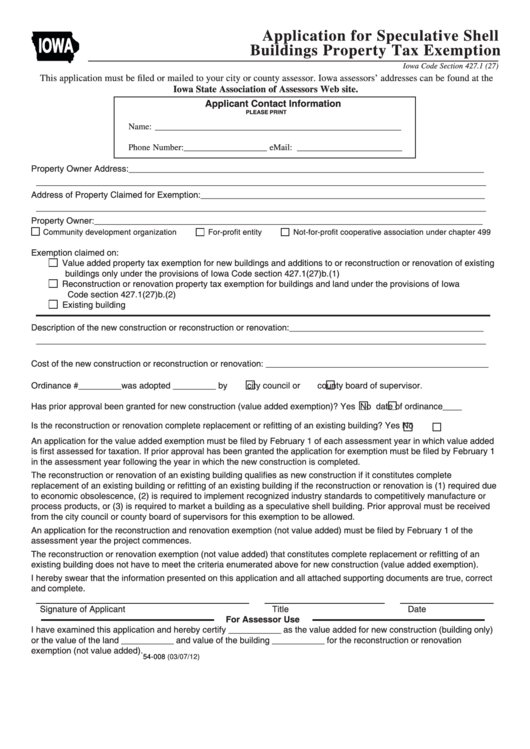

Application for Speculative Shell

IOWA

Buildings Property Tax Exemption

Iowa Code Section 427.1 (27)

This application must be filed or mailed to your city or county assessor. Iowa assessors’ addresses can be found at the

Iowa State Association of Assessors Web site.

Applicant Contact Information

PLEASE PRINT

Name: ________________________________________________________

Phone Number:___________________ eMail: ________________________

Property Owner Address: ___________________________________________________________________________

_______________________________________________________________________________________________

Address of Property Claimed for Exemption: ____________________________________________________________

_______________________________________________________________________________________________

Property Owner: __________________________________________________________________________________

Community development organization

For-profit entity

Not-for-profit cooperative association under chapter 499

Exemption claimed on:

Value added property tax exemption for new buildings and additions to or reconstruction or renovation of existing

buildings only under the provisions of Iowa Code section 427.1(27)b.(1)

Reconstruction or renovation property tax exemption for buildings and land under the provisions of Iowa

Code section 427.1(27)b.(2)

Existing building

Description of the new construction or reconstruction or renovation: _________________________________________

_______________________________________________________________________________________________

Cost of the new construction or reconstruction or renovation: _______________________________________________

Ordinance #_________was adopted _________ by

city council or

county board of supervisor.

Has prior approval been granted for new construction (value added exemption)? Yes

No

date of ordinance ____

Is the reconstruction or renovation complete replacement or refitting of an existing building? Yes

No

An application for the value added exemption must be filed by February 1 of each assessment year in which value added

is first assessed for taxation. If prior approval has been granted the application for exemption must be filed by February 1

in the assessment year following the year in which the new construction is completed.

The reconstruction or renovation of an existing building qualifies as new construction if it constitutes complete

replacement of an existing building or refitting of an existing building if the reconstruction or renovation is (1) required due

to economic obsolescence, (2) is required to implement recognized industry standards to competitively manufacture or

process products, or (3) is required to market a building as a speculative shell building. Prior approval must be received

from the city council or county board of supervisors for this exemption to be allowed.

An application for the reconstruction and renovation exemption (not value added) must be filed by February 1 of the

assessment year the project commences.

The reconstruction or renovation exemption (not value added) that constitutes complete replacement or refitting of an

existing building does not have to meet the criteria enumerated above for new construction (value added exemption).

I hereby swear that the information presented on this application and all attached supporting documents are true, correct

and complete.

Signature of Applicant

Title

Date

For Assessor Use

I have examined this application and hereby certify ___________ as the value added for new construction (building only)

or the value of the land ___________ and value of the building ___________ for the reconstruction or renovation

exemption (not value added).

54-008

(03/07/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1