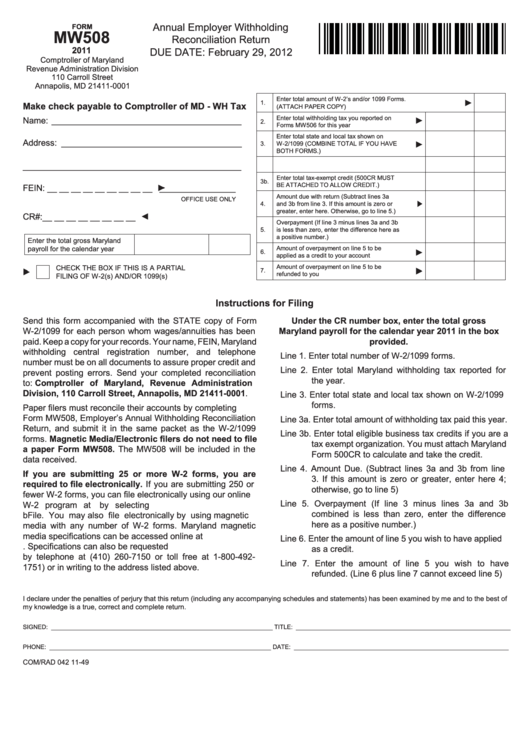

Annual Employer Withholding

FORM

MW508

Reconciliation Return

2011

DUE DATE: February 29, 2012

Comptroller of Maryland

115080049

Revenue Administration Division

110 Carroll Street

Annapolis, MD 21411-0001

Enter total amount of W-2’s and/or 1099 Forms.

1.

Make check payable to Comptroller of MD - WH Tax

(ATTACH PAPER COPY)

Enter total withholding tax you reported on

Name: ________________________________________

2.

Forms MW506 for this year

Enter total state and local tax shown on

Address: ______________________________________

3.

W-2/1099 (COMBINE TOTAL IF YOU HAVE

BOTH FORMS.)

______________________________________________

3a.

Enter total withholding tax paid

Enter total tax-exempt credit (500CR MUST

3b.

BE ATTACHED TO ALLOW CREDIT.)

FEIN: __ __ __ __ __ __ __ __ __

________________

Amount due with return (Subtract lines 3a

OFFICE USE ONLY

4.

and 3b from line 3. If this amount is zero or

greater, enter here. Otherwise, go to line 5.)

CR#:__ __ __ __ __ __ __ __

Overpayment (If line 3 minus lines 3a and 3b

5.

is less than zero, enter the difference here as

a positive number.)

Enter the total gross Maryland

payroll for the calendar year

Amount of overpayment on line 5 to be

6.

applied as a credit to your account

Amount of overpayment on line 5 to be

CHECK THE BOX IF THIS IS A PARTIAL

7.

refunded to you

FILING OF W-2(s) AND/OR 1099(s)

Instructions for Filing

Send this form accompanied with the STATE copy of Form

Under the CR number box, enter the total gross

W-2/1099 for each person whom wages/annuities has been

Maryland payroll for the calendar year 2011 in the box

paid. Keep a copy for your records. Your name, FEIN, Maryland

provided.

withholding central registration number, and telephone

Line 1. Enter total number of W-2/1099 forms.

number must be on all documents to assure proper credit and

Line 2. Enter total Maryland withholding tax reported for

prevent posting errors. Send your completed reconciliation

the year.

to: Comptroller of Maryland, Revenue Administration

Division, 110 Carroll Street, Annapolis, MD 21411-0001.

Line 3. Enter total state and local tax shown on W-2/1099

forms.

Paper filers must reconcile their accounts by completing

Form MW508, Employer’s Annual Withholding Reconciliation

Line 3a. Enter total amount of withholding tax paid this year.

Return, and submit it in the same packet as the W-2/1099

Line 3b. Enter total eligible business tax credits if you are a

forms. Magnetic Media/Electronic filers do not need to file

tax exempt organization. You must attach Maryland

a paper Form MW508. The MW508 will be included in the

Form 500CR to calculate and take the credit.

data received.

Line 4. Amount Due. (Subtract lines 3a and 3b from line

If you are submitting 25 or more W-2 forms, you are

3. If this amount is zero or greater, enter here 4;

required to file electronically. If you are submitting 250 or

otherwise, go to line 5)

fewer W-2 forms, you can file electronically using our online

Line 5. Overpayment (If line 3 minus lines 3a and 3b

W-2 program at by selecting

combined is less than zero, enter the difference

bFile. You may also file electronically by using magnetic

here as a positive number.)

media with any number of W-2 forms. Maryland magnetic

media specifications can be accessed online at www.

Line 6. Enter the amount of line 5 you wish to have applied

. Specifications can also be requested

as a credit.

by telephone at (410) 260-7150 or toll free at 1-800-492-

Line 7. Enter the amount of line 5 you wish to have

1751) or in writing to the address listed above.

refunded. (Line 6 plus line 7 cannot exceed line 5)

I declare under the penalties of perjury that this return (including any accompanying schedules and statements) has been examined by me and to the best of

my knowledge is a true, correct and complete return.

SIGNED: _________________________________________________________________ TITLE: _______________________________________________________________

PHONE: _________________________________________________________________ DATE: _______________________________________________________________

COM/RAD 042

11-49

1

1