Form 8805 - Foreign Partner'S Information Statement Of Section 1446 Withholding Tax - 2001

ADVERTISEMENT

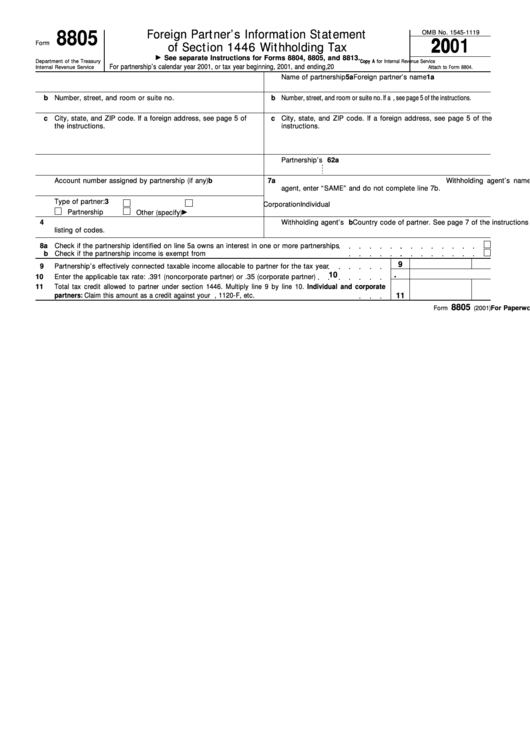

8805

Foreign Partner’s Information Statement

OMB No. 1545-1119

2001

Form

of Section 1446 Withholding Tax

See separate Instructions for Forms 8804, 8805, and 8813.

Department of the Treasury

Copy A for Internal Revenue Service

For partnership’s calendar year 2001, or tax year beginning

, 2001, and ending

, 20

Internal Revenue Service

Attach to Form 8804.

1a

Foreign partner’s name

5a

Name of partnership

b

Number, street, and room or suite no.

b

Number, street, and room or suite no. If a P.O. box, see page 5 of the instructions.

c

City, state, and ZIP code. If a foreign address, see page 5 of

c

City, state, and ZIP code. If a foreign address, see page 5 of the

the instructions.

instructions.

2a

U.S. identifying number of foreign partner subject to withholding

6

Partnership’s U.S. employer identification number

b

Account number assigned by partnership (if any)

7a

Withholding agent’s name. If partnership is also the withholding

agent, enter “SAME” and do not complete line 7b.

3

Type of partner:

Individual

Corporation

Partnership

Other (specify)

4

Country code of partner. See page 7 of the instructions for a

b

Withholding agent’s U.S. employer identification number

listing of codes.

8a Check if the partnership identified on line 5a owns an interest in one or more partnerships

b Check if the partnership income is exempt from U.S. tax for the partner identified on line 1a

9

9

Partnership’s effectively connected taxable income allocable to partner for the tax year

.

10

10

Enter the applicable tax rate: .391 (noncorporate partner) or .35 (corporate partner)

11

Total tax credit allowed to partner under section 1446. Multiply line 9 by line 10. Individual and corporate

partners: Claim this amount as a credit against your U.S. income tax on Form 1040NR, 1120-F, etc.

11

8805

For Paperwork Reduction Act Notice, see separate Instructions for Forms 8804, 8805, and 8813.

Cat. No. 10078E

Form

(2001)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4