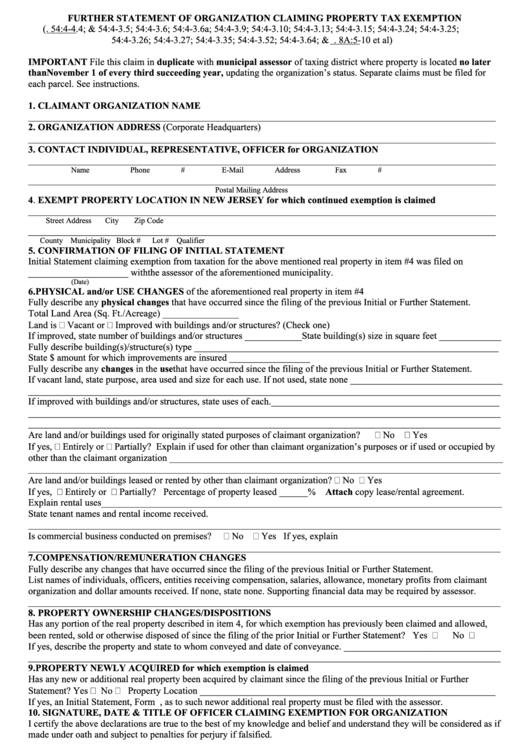

FURTHER STATEMENT OF ORGANIZATION CLAIMING PROPERTY TAX EXEMPTION

(N.J.S.A. 54:4-4.4; & 54:4-3.5; 54:4-3.6; 54:4-3.6a; 54:4-3.9; 54:4-3.10; 54:4-3.13; 54:4-3.15; 54:4-3.24; 54:4-3.25;

54:4-3.26; 54:4-3.27; 54:4-3.35; 54:4-3.52; 54:4-3.64; & N.J.S.A. 8A:5-10 et al)

IMPORTANT File this claim in duplicate with municipal assessor of taxing district where property is located no later

than November 1 of every third succeeding year, updating the organization’s status. Separate claims must be filed for

each parcel. See instructions.

1. CLAIMANT ORGANIZATION NAME

__________________________________________________________________________________________________

2. ORGANIZATION ADDRESS (Corporate Headquarters)

__________________________________________________________________________________________________

3. CONTACT INDIVIDUAL, REPRESENTATIVE, OFFICER for ORGANIZATION

__________________________________________________________________________________________________

Name

Phone #

E-Mail Address

Fax #

__________________________________________________________________________________________________

Postal Mailing Address

4. EXEMPT PROPERTY LOCATION IN NEW JERSEY for which continued exemption is claimed

__________________________________________________________________________________________________

Street Address

City

Zip Code

__________________________________________________________________________________________________

County

Municipality

Block #

Lot #

Qualifier

5. CONFIRMATION OF FILING OF INITIAL STATEMENT

Initial Statement claiming exemption from taxation for the above mentioned real property in item #4 was filed on

_____________________ with the assessor of the aforementioned municipality.

(Date)

6. PHYSICAL and/or USE CHANGES of the aforementioned real property in item #4

Fully describe any physical changes that have occurred since the filing of the previous Initial or Further Statement.

Total Land Area (Sq. Ft./Acreage) ________________

Land is

Vacant or

Improved with buildings and/or structures? (Check one)

If improved, state number of buildings and/or structures ____________State building(s) size in square feet _____________

Fully describe building(s)/structure(s) type ________________________________________________________________

State $ amount for which improvements are insured _________________

Fully describe any changes in the use that have occurred since the filing of the previous Initial or Further Statement.

If vacant land, state purpose, area used and size for each use. If not used, state none ________________________________

___________________________________________________________________________________________________

If improved with buildings and/or structures, state uses of each.________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

Are land and/or buildings used for originally stated purposes of claimant organization?

No

Yes

If yes,

Entirely or

Partially? Explain if used for other than claimant organization’s purposes or if used or occupied by

other than the claimant organization ______________________________________________________________________

___________________________________________________________________________________________________

Are land and/or buildings leased or rented by other than claimant organization?

No

Yes

If yes,

Entirely or

Partially? Percentage of property leased ______% Attach copy lease/rental agreement.

Explain rental uses____________________________________________________________________________________

State tenant names and rental income received.

___________________________________________________________________________________________________

Is commercial business conducted on premises?

No

Yes If yes, explain

___________________________________________________________________________________________________

7. COMPENSATION/REMUNERATION CHANGES

Fully describe any changes that have occurred since the filing of the previous Initial or Further Statement.

List names of individuals, officers, entities receiving compensation, salaries, allowance, monetary profits from claimant

organization and dollar amounts received. If none, state none. Supporting financial data may be required by assessor.

___________________________________________________________________________________________________

8. PROPERTY OWNERSHIP CHANGES/DISPOSITIONS

Has any portion of the real property described in item 4, for which exemption has previously been claimed and allowed,

been rented, sold or otherwise disposed of since the filing of the prior Initial or Further Statement? Yes

No

If yes, describe the property and state to whom conveyed and date of conveyance. _________________________________

___________________________________________________________________________________________________

9. PROPERTY NEWLY ACQUIRED for which exemption is claimed

Has any new or additional real property been acquired by claimant since the filing of the previous Initial or Further

Statement? Yes

No

Property Location ______________________________________________________________

If yes, an Initial Statement, Form I.S., as to such new or additional real property must be filed with the assessor.

10. SIGNATURE, DATE & TITLE OF OFFICER CLAIMING EXEMPTION FOR ORGANIZATION

I certify the above declarations are true to the best of my knowledge and belief and understand they will be considered as if

made under oath and subject to penalties for perjury if falsified.

Signature_______________________________ Official Title or Position _______________________Date___________

Official Use

Denied

Approved

Exempt Property Code______________________________

Assessor______________________________________________________________________Date__________________

Form F.S. Rev. April 2002. This form is prescribed by the Director, Division of Taxation, as required by law, and may not be altered

without the approval of the Director.

1

1 2

2