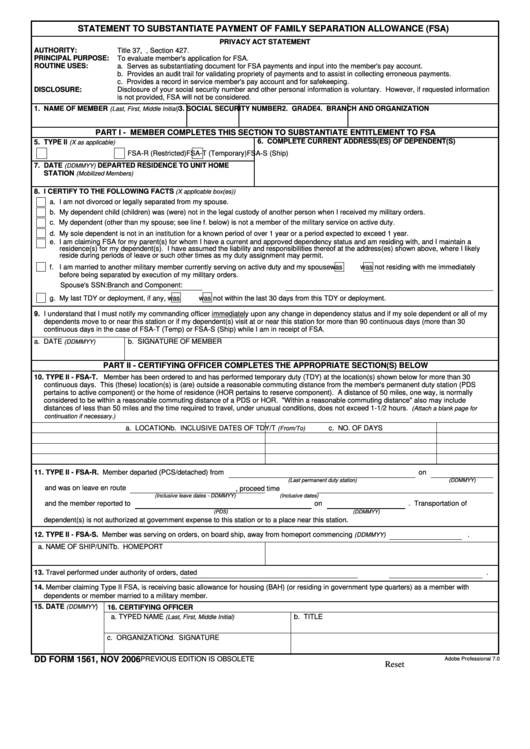

STATEMENT TO SUBSTANTIATE PAYMENT OF FAMILY SEPARATION ALLOWANCE (FSA)

PRIVACY ACT STATEMENT

AUTHORITY:

Title 37, U.S. Code, Section 427.

PRINCIPAL PURPOSE:

To evaluate member's application for FSA.

ROUTINE USES:

a. Serves as substantiating document for FSA payments and input into the member's pay account.

b. Provides an audit trail for validating propriety of payments and to assist in collecting erroneous payments.

c. Provides a record in service member's pay account and for safekeeping.

DISCLOSURE:

Disclosure of your social security number and other personal information is voluntary. However, if requested information

is not provided, FSA will not be considered.

1. NAME OF MEMBER

2. GRADE

3. SOCIAL SECURITY NUMBER

4. BRANCH AND ORGANIZATION

(Last, First, Middle Initial)

PART I - MEMBER COMPLETES THIS SECTION TO SUBSTANTIATE ENTITLEMENT TO FSA

6. COMPLETE CURRENT ADDRESS(ES) OF DEPENDENT(S)

5. TYPE II

(X as applicable)

FSA-T (Temporary)

FSA-R (Restricted)

FSA-S (Ship)

7. DATE

DEPARTED RESIDENCE TO UNIT HOME

(DDMMYY)

STATION

(Mobilized Members)

8. I CERTIFY TO THE FOLLOWING FACTS

(X applicable box(es))

a. I am not divorced or legally separated from my spouse.

b. My dependent child (children) was (were) not in the legal custody of another person when I received my military orders.

c. My dependent (other than my spouse; see line f. below) is not a member of the military service on active duty.

d. My sole dependent is not in an institution for a known period of over 1 year or a period expected to exceed 1 year.

e. I am claiming FSA for my parent(s) for whom I have a current and approved dependency status and am residing with, and I maintain a

residence(s) for my dependent(s). I have assumed the liability and responsibilities thereof at the address(es) shown above, where I likely

reside during periods of leave or such other times as my duty assignment may permit.

f. I am married to another military member currently serving on active duty and my spouse

was

was not residing with me immediately

before being separated by execution of my military orders.

Spouse's SSN:

Branch and Component:

g. My last TDY or deployment, if any,

was

was not within the last 30 days from this TDY or deployment.

9. I understand that I must notify my commanding officer immediately upon any change in dependency status and if my sole dependent or all of my

dependents move to or near this station or if my dependent(s) visit at or near this station for more than 90 continuous days (more than 30

continuous days in the case of FSA-T (Temp) or FSA-S (Ship) while I am in receipt of FSA.

a. DATE

b. SIGNATURE OF MEMBER

(DDMMYY)

PART II - CERTIFYING OFFICER COMPLETES THE APPROPRIATE SECTION(S) BELOW

10. TYPE II - FSA-T. Member has been ordered to and has performed temporary duty (TDY) at the location(s) shown below for more than 30

continuous days. This (these) location(s) is (are) outside a reasonable commuting distance from the member's permanent duty station (PDS

pertains to active component) or the home of residence (HOR pertains to reserve component). A distance of 50 miles, one way, is normally

considered to be within a reasonable commuting distance of a PDS or HOR. "Within a reasonable commuting distance" also may include

distances of less than 50 miles and the time required to travel, under unusual conditions, does not exceed 1-1/2 hours.

(Attach a blank page for

continuation if necessary.)

a. LOCATION

b. INCLUSIVE DATES OF TDY/T

c. NO. OF DAYS

(From/To)

11. TYPE II - FSA-R. Member departed (PCS/detached) from

on

(Last permanent duty station)

(DDMMYY)

and was on leave en route

, proceed time

(Inclusive leave dates - DDMMYY)

(Inclusive dates)

and the member reported to

on

. Transportation of

(PDS)

(DDMMYY)

dependent(s) is not authorized at government expense to this station or to a place near this station.

12. TYPE II - FSA-S. Member was serving on orders, on board ship, away from homeport commencing

.

(DDMMYY)

a. NAME OF SHIP/UNIT

b. HOMEPORT

13. Travel performed under authority of orders

, dated

.

14. Member claiming Type II FSA, is receiving basic allowance for housing (BAH) (or residing in government type quarters) as a member with

dependents or member married to a military member.

15. DATE

)

(DDMMYY

16. CERTIFYING OFFICER

a. TYPED NAME

b. TITLE

(Last, First, Middle Initial)

c. ORGANIZATION

d. SIGNATURE

DD FORM 1561, NOV 2006

PREVIOUS EDITION IS OBSOLETE

Adobe Professional 7.0

Reset

1

1