Dd Form 2656 Instructions - Data For Payment Of Retired Personnel - April 2009

ADVERTISEMENT

DATA FOR PAYMENT OF RETIRED PERSONNEL

PRIVACY ACT STATEMENT

AUTHORITY: 10 U.S.C. Chapter 73, subchapters II and III; DoD Instruction 1332.42, Survivor Annuity Program Administration, DoD Financial

Management Regulation, Volume 7B, Chapter 42; and E.O. 9397 (SSN).

PRINCIPAL PURPOSE(S): To collect information needed to establish a retired/retainer pay account, including designation of beneficiaries for

unpaid retired pay, state tax withholding election, information on dependents, and to establish a Survivor Benefit Plan election.

ROUTINE USE(S): Disclosures are made to the Department of Veterans Affairs (DVA) regarding establishments, changes and discontinuing of DVA

compensation to retirees and annuitants.

To former spouses for purposes of providing information, consistent with the requirements of 10 U.S.C. Section 1450(f)(3), regarding Survivor

Benefit Plan coverage.

To spouses for purposes of providing information, consistent with the requirements of 10 U.S.C. Section 1448(a), regarding Survivor Benefit Plan

coverage.

DISCLOSURE: Voluntary; however, failure to provide requested information will result in delays in initiating retired/retainer pay.

INSTRUCTIONS

proper completion and submission of this form. You should maintain

GENERAL.

these instructions along with a copy of the form as a permanent

record of pay data. Please complete the form by typing or printing

1. Read these instructions and Privacy Act Statement carefully before

in ink.

completing the data form.

3. Ensure that you promptly advise DFAS - Cleveland of changes to

2. The Defense Finance and Accounting Service (DFAS) - Cleveland will

your marital/family status and any changes to your correspondence

establish your retired/retainer pay account based on the data provided on

address and direct deposit information (or your Reserve Component if a

the form and your retirement/transfer orders. Your personnel office,

gray area retiree).

disbursing/finance office, and SBP Counselor will assist you in the

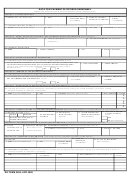

SECTION I - PAY IDENTIFICATION.

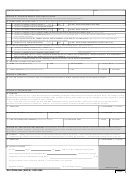

SECTION V - DESIGNATION OF BENEFICIARIES FOR UNPAID

RETIRED PAY.

ITEMS 1 and 2. Self-explanatory.

ITEM 13. Upon your death, 10 U.S. Code Section 2771 provides that

ITEM 3. If you are retiring from active duty, enter the date you transfer to

any pay due and unpaid will be paid to the surviving person highest on

the Fleet Reserve or date of retirement. If you are a Reserve member

the following list: (1) beneficiary(ies) designated in writing; (2) your

qualified to retire under 10 U.S. Code, Chapter 1223, enter either the date

spouse; (3) your children and their descendants, by representation; (4)

of your 60th birthday or, a later date on which you desire to begin

receiving retired pay.

your parents in equal parts, or if either is dead, the survivor; (5) the legal

representative of your estate, and (6) person(s) entitled under the law of

ITEMS 4 and 5. Self-explanatory.

your domicile. Therefore, if you choose to designate a beneficiary or

beneficiaries, you must complete Items 13.a. through 13.e. If you

ITEM 6. Enter the address and telephone number (include area code)

designate multiple beneficiaries, you can either provide a SHARE

where you can be contacted.

percentage to be paid to each person or leave the SHARE percentage

blank. If you leave the SHARE percentage blank, any retired pay you are

SECTION II - DIRECT DEPOSIT/ELECTRONIC FUND TRANSFER

owed when you die will be divided equally among your designated

INFORMATION.

beneficiaries. If you list more than one person with a 100% SHARE, the

This section must be completed. Your net retired/retainer pay must be

beneficiaries will be paid in the order as you list them on the form. If, for

sent to your financial institution by direct deposit/electronic fund transfer

example, you designate two beneficiaries, then the SHARE percentage

(DD/EFT).

must either be 100% for each beneficiary, or the SHARE percentages

when added together must equal 100%. If you designate more than one

ITEMS 7 through 10. If you are directing your retired pay to the same

person, and the total percentage designated is greater than 100%, the

account number and financial institution to which you directed your active

person listed first is considered the primary beneficiary. Use the

duty pay, annotate Items 7 through 10 "SAME AS ACTIVE DUTY". If you

Remarks section for additional beneficiary information.

have a copy of the Direct Deposit Authorization form used to establish

your DD/EFT for your active duty pay, attach a copy to this form.

If you do not designate a beneficiary or beneficiaries in Item 13, or all

designated beneficiaries have died before the date of your death, any

If you are not currently on DD/EFT or are a Reservist, you must

unpaid retired pay will be paid to the living person or persons in the

complete Items 7 through 10. Provide the nine digit Routing Transit

highest category of beneficiary listed above, as required by law.

Number (RTN) of your financial institution in Item 7. The RTN is the nine

digit number located in the lower left-hand corner of either your checks or

SECTION VI - FEDERAL INCOME TAX WITHHOLDING

check deposit tickets. If you still are unable to obtain the RTN, you will

INFORMATION.

have to contact your financial institution to which you want your

retired/retainer pay directed and request the RTN. Also, indicate whether

your account is (S) for Savings or (C) for Checking account in Item 8,

Complete this section after determining your allowed exemptions with

your account number in Item 9, and your financial institution name and

the aid of your disbursing/finance office, or from the instruc- tions

address in Item 10.

available on IRS Form W-4, or other available IRS publications. Leave

Items 14 through 16 blank if completing Item 17.

SECTION III - SEPARATION PAYMENT INFORMATION.

ITEM 14. Mark the status you desire to claim.

ITEM 11. Complete if you are retiring from active duty or a

member/former member of the Reserve Component not on active duty

retiring at age 60.

ITEM 15. Enter the number of exemptions claimed.

11.a. through 11.c. Complete if you received any type of separation

ITEM 16. Enter the dollar amount of additional Federal income tax you

bonus. In Item11.a, enter an X in the YES block. In Item 11.b., enter

desire withheld from each month's pay. Leave blank if you do not desire

"SE" for Severance Pay, "SP" for Separation Pay, "VSI" for Voluntary

additional withholding.

Separation Incentive, and "SSB" for Special Separation Bonus. In Item

11.c., enter the lump-sum gross amount for Severance, Separation and

ITEM 17. Enter the word "EXEMPT" in this item only if you meet all the

Special Separation Bonus payments and the annual installment gross

following criteria: (1) you had no Federal income tax liability in the prior

amount for Voluntary Separation Incentive payments. Be sure to attach a

copy of the orders that authorized the payment and a copy of your DD

year; (2) you anticipate no Federal income tax liability this year; and (3)

Form 214.

you therefore desire no Federal income tax to be withheld from your

retired/retainer pay.

SECTION IV - MEMBER OF THE RESERVE COMPONENT.

NOTE: You must file a new exemption claim form with DFAS - Cleveland

ITEM 12. Complete if you are a member/former member of a Reserve

by February 15th of each year for which you claim exemption from

Component, not on active duty, retiring at age 60.

withholding.

PREVIOUS EDITION IS OBSOLETE

DD FORM 2656 INSTRUCTIONS, APR 2009

Adobe Professional 8.0

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4