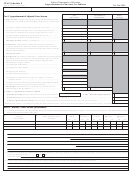

Instructions For It-65 Schedule E - Apportionment Of Income For Indiana Page 2

ADVERTISEMENT

Indiana resident; and commercial loans and installment

Total Receipts

obligations not secured by real or tangible personal property

Complete all lines as indicated. Add receipt factor lines

are attributable to Indiana if the proceeds of the loan are to be

3(a) through 3(f) in column A, enter total on line 3A. Enter

applied in Indiana. Interest income, merchant discounts, travel

total receipts everywhere on line 3B. See line 4(a) for

and entertainment credit card receivables and credit card

calculation of the percentage. Round the percentage to the

holder’s fees are attributable to the state where the card charges

nearest second decimal place.

and fees are regularly billed. Receipts from the performance

4. Summary: Apportionment of Income for Indiana

of fiduciary and other services are attributable to the state

(a) Divide sum on line 3A by the total from line 3B. Multiply

where the benefits of the services are consumed. Receipts

by 100 to arrive at a percentage rounded to the nearest

from the issuance of traveler’s checks, money orders, or United

second decimal place. Enter the quotient on the 4(a)1

States savings bonds are attributable to the state where those

space provided and multiply by the 200% (2.0) double

items are purchased. Receipts in the form of dividends from

weight adjustment. Enter the product on line 4a of

investments are attributable to Indiana if the commercial

column C.

domicile is in Indiana; and (4) gross receipts from the

(b) Add entries on lines 1C, 2C, and 4a of column C.

performance of services are in Indiana if the services are

Enter the sum of the percentages on line 4b.

performed in this state. If such services are performed partly

(c) Divide the total percentage entered on line 4b by 4.

within and partly outside Indiana, a portion of the gross receipts

Enter the average Indiana apportionment percentage

from performance of the services shall be attributed to Indiana

(round to the nearest second decimal place) on line

based upon the ratio the direct costs incurred in Indiana bear

4c and carry to line 4 of Form IT-65.

to the total direct costs of the services, unless the services

The property and payroll factors are each valued as a

are otherwise directly attributed to Indiana according to IC 6-

factor of 1 in the apportionment of income formula. The

3-2-2.2.

receipts factor is valued as a factor of 2. The combined three-

factor denominator equals 4. When there is a total absence

Sales to the United States Government: The United States

of one of these factors for column B, you must divide the sum

Government is the purchaser when it makes direct payment

of the percentages by the number of the remaining factor values

to the seller. A sale to the United States Government of

present in the apportionment formula.

tangible personal property is in Indiana if it is shipped from an

office, store, warehouse, or other place of storage in Indiana.

Part II - Business/Other Income Questionnaire

See above rules for sales other than tangible personal property

Complete all applicable questions in this section. If income

if such sales are made to the United States Government.

is apportioned, list (a) all business locations where the

Other gross receipts under (f) Other, report other gross

partnership has operations. Indicate (b) the nature of the

business receipts not included elsewhere, and pro rata gross

business activity at each location, including whether a location

receipts from unitary-partnership(s), excluding from the factor

(c) accepts orders in that state; (d) is registered to do business

that portion of distributive share income derived from a

in that state, or (e) files income tax returns in other states,

previously apportioned partnership source.

and whether property in the other states is (f) owned or (g)

leased.

You must attach the completed IT-65 Schedule E,

Apportionment of Income to your return.

18

14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2