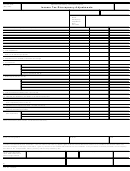

Department of the Treasury-Internal Revenue Service

4549-E

Form

Income Tax Discrepancy Adjustments

Page

of

(Rev. 12-2004)

Name and Address of Taxpayer

SS or EI Number

Return Form No.:

Person with whom

Name and Title:

examination

changes were

discussed.

Period End

Period End

Period End

17. Penalties

a.

b.

c.

d.

e.

f.

g.

h.

i.

j.

k.

l.

m.

n.

18. Total Penalties

Underreporter attributable to negligence: (1981 - 1987) A tax addition of

50 percent of the interest due on underpayment will accrue until paid or

assessment.

Underreporter attributable to fraud:: (1981 - 1987)

A tax addition of 50 percent of the interest due on underpayment

will accrue until paid or assessed.

Underreporter attributable to Tax Motivated Transactions TMT interest

will accrue and be assessed at 120% of underpayment rate in

accordance with IRC 6621(c)

19. Summary of Taxes, Penalties and Interest:

a. Balance due or Overpayment Taxes - Line 16, Page 1

b.

Penalties (Line 18, Page 2) - computed to

c.

Interest (IRC § 6601) - computed to

d.

TMT Interest - computed

on TMT underpayment

e. Amount due or refund (sum of Lines a, b, c and d)

Other Information:

Examiner's Signature:

Employee ID:

Office:

Date:

Consent to Assessment and Collection- I do not wish to exercise my appeal rights with the Internal Revenue Service or to contest in the United States

Tax Court the findings in this report. Therefore, I give my consent to the immediate assessment and collection of any increase in tax and penalties, and

accept any decrease in tax and penalties shown above, plus additional interest as provided by law. It is understood that this report is subject to

acceptance by the Area Director, Area Manager or Director of Field Operations.

PLEASE NOTE: If a joint return was filed. BOTH taxpayers must sign

Signature of Taxpayer

Date:

Signature of Taxpayer

Date:

By:

Date:

Title:

Catalog Number 13383E

publish.no.irs.gov

Form 4549-E

1

1 2

2