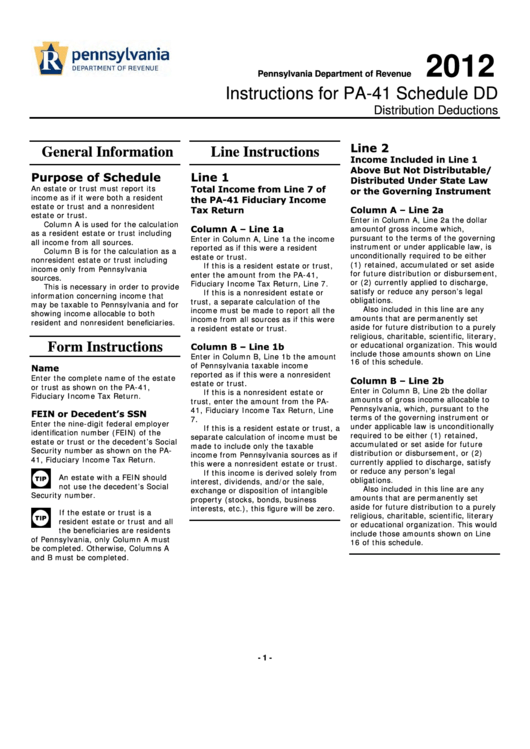

Instructions For Pa-41 Schedule Dd - Pennsylvania Department Of Revenue - 2012

ADVERTISEMENT

2012

Pennsylvania Department of Revenue

Instructions for PA-41 Schedule DD

Distribution Deductions

Line 2

General Information

Line Instructions

Income Included in Line 1

Above But Not Distributable/

Purpose of Schedule

Line 1

Distributed Under State Law

An estate or trust must report its

Total Income from Line 7 of

or the Governing Instrument

income as if it were both a resident

the PA-41 Fiduciary Income

estate or trust and a nonresident

Tax Return

Column A – Line 2a

estate or trust.

Enter in Column A, Line 2a the dollar

Column A is used for the calculation

Column A – Line 1a

amount of gross income which,

as a resident estate or trust including

pursuant to the terms of the governing

Enter in Column A, Line 1a the income

all income from all sources.

instrument or under applicable law, is

reported as if this were a resident

Column B is for the calculation as a

unconditionally required to be either

estate or trust.

nonresident estate or trust including

(1) retained, accumulated or set aside

If this is a resident estate or trust,

income only from Pennsylvania

for future distribution or disbursement,

enter the amount from the PA-41,

sources.

or (2) currently applied to discharge,

Fiduciary Income Tax Return, Line 7.

This is necessary in order to provide

satisfy or reduce any person’s legal

If this is a nonresident estate or

information concerning income that

obligations.

trust, a separate calculation of the

may be taxable to Pennsylvania and for

Also included in this line are any

income must be made to report all the

showing income allocable to both

amounts that are permanently set

income from all sources as if this were

resident and nonresident beneficiaries.

aside for future distribution to a purely

a resident estate or trust.

religious, charitable, scientific, literary,

or educational organization. This would

Form Instructions

Column B – Line 1b

include those amounts shown on Line

Enter in Column B, Line 1b the amount

16 of this schedule.

of Pennsylvania taxable income

Name

reported as if this were a nonresident

Enter the complete name of the estate

Column B – Line 2b

estate or trust.

or trust as shown on the PA-41,

Enter in Column B, Line 2b the dollar

If this is a nonresident estate or

Fiduciary Income Tax Return.

amounts of gross income allocable to

trust, enter the amount from the PA-

Pennsylvania, which, pursuant to the

41, Fiduciary Income Tax Return, Line

FEIN or Decedent’s SSN

terms of the governing instrument or

7.

Enter the nine-digit federal employer

under applicable law is unconditionally

If this is a resident estate or trust, a

identification number (FEIN) of the

required to be either (1) retained,

separate calculation of income must be

estate or trust or the decedent’s Social

accumulated or set aside for future

made to include only the taxable

Security number as shown on the PA-

distribution or disbursement, or (2)

income from Pennsylvania sources as if

41, Fiduciary Income Tax Return.

currently applied to discharge, satisfy

this were a nonresident estate or trust.

or reduce any person’s legal

If this income is derived solely from

An estate with a FEIN should

obligations.

interest, dividends, and/or the sale,

not use the decedent’s Social

Also included in this line are any

exchange or disposition of intangible

Security number.

amounts that are permanently set

property (stocks, bonds, business

aside for future distribution to a purely

interests, etc.), this figure will be zero.

If the estate or trust is a

religious, charitable, scientific, literary

resident estate or trust and all

or educational organization. This would

the beneficiaries are residents

include those amounts shown on Line

of Pennsylvania, only Column A must

16 of this schedule.

be completed. Otherwise, Columns A

and B must be completed.

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3