AZ Form 319 (2001) Page 3

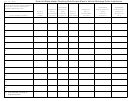

Part VI Available Credit Carryover for Taxpayer as Purchaser or Transferee of House or Dwelling Unit

(a)

(b)

(c)

(d)

Carryover

Original credit

Amount

Available carryover -

credit from

amount

previously used

subtract column (c)

taxable year ending

from column (b)

22

23

24

25

26

27

Total available carryover............................................................................................................................................

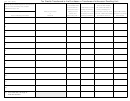

Part VII Total Available Credit

28 Current year’s credit for taxpayer that built the house or dwelling unit. Individuals, corporations,

or S corporations - enter the amount from Part I, line 3. S corporation shareholders - enter the amount

from Part III, line 9. Partners of a partnership - enter the amount from Part IV, line 13 ................................................................... 28

29 Current year’s credit for purchaser or transferee of house or dwelling unit. Individuals, corporations,

and S corporations - enter the amount from Part II, line 4. S corporation shareholders - enter the amount

from Part III, line 10. Partners of a partnership - enter the amount from Part IV, line 14 ................................................................. 29

30 Available credit carryover for taxpayer as builder of house or dwelling unit - enter amount from Part V,

line 21, column (f) ............................................................................................................................................................................ 30

31 Available credit carryover for taxpayer as purchaser or transferee of house or dwelling unit - enter amount

from Part VI, line 27, column (d) ...................................................................................................................................................... 31

32 Total available credit - add lines 28, 29, 30, and 31. Enter the total here and on Form 300, Part I, line 13,

or Form 301, Part I, line 14 ...........................................................................................................................................................

32

ADOR 91-0014 (01) rj

1

1 2

2 3

3 4

4 5

5