Page 5

Direct Deposit

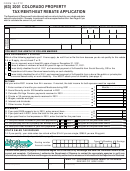

You are not required to enroll in Direct Deposit, but it is highly recommended. For faster processing of your rebate, enter the

routing and account numbers and account type. Include hyphens, but do NOT enter spaces or special symbols. We recommend

that you contact your financial institution to ensure you are using the correct information and that they will honor a direct deposit.

See the sample check below to assist you in finding the account and routing numbers.

Intercepted Rebates

The Department will intercept your rebate if you owe back taxes or if you owe a balance to another Colorado government agency.

If you are filing a joint return and only one party is responsible for the unpaid debt, you may file a written claim to Injured Spouse

Desk, 1375 Sherman St, Room 240, Denver, CO 80261. Claims must include copies of all W-2, W-2G, any 1099 and/or TPQY

statements received by both parties. DO NOT attach your claim to this application. It will not be processed.

Signature(s)

Sign and date your application. Failure to sign and date your application will cause delays and/or denial of your rebate.

Affidavit

Complete the affidavit for lawful U.S. presence.

Special Circumstances

Disabled Children: Complete the following to calculate the PTC rebate for disabled children:

a) Enter the total income for the disabled child.

$

b) Enter the total income for the household, including the disabled child.

$

%

c) Divide line A by line B. Enter the result.

Multiply the amount of property tax, rent, and/or heat/fuel expenses by the amount on line c. This is the child’s portion of the expense.

Example: Jim is a disabled child under age 18, who received $6,000 in SSI this year. His parents, who do not

qualify for the PTC rebate, earned $8,000 from wages this year. The family pays $3,600 in rent and $300 heat/fuel

to heat the home.

a) $6,000

b) $14,000

c) 42.9%

Line 9 of Jim’s application is $1,544 ($3,600 x 0.429) and line 10 is $129 ($300 x 0.429).

Married Persons: If you were legally married but never divorced, then you are still considered married. This is true even if

you have a legal separation. If you are married, you MUST include all information about your spouse including all income

and expenses he/she had in 2016.

Non-married Persons Sharing a Home: If you share a home with another adult and you share the expenses of the home,

please note the following:

Property Tax

One Owner: Only the owner of the home should enter the property tax amount on their application. If the other person

living in the home pays the owner rent, the owner must report the rent as income on line 7 and the renter can report

the rent expense on their application on line 9.

or

Joint Ownership: Each owner may enter the property tax amount they paid on their own application. The amount

should be calculated according to their ownership percentage in the property. Enter the appropriate amount on

line 8 of each person’s application.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12