Page 6

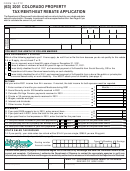

Rent and/or Heat/Fuel

Each qualified person may enter the amount of rent and/or heat/fuel expenses on lines 9 and 10 of their own application.

Example: Bob and Joe share an apartment and they split expenses. Bob pays 55% and Joe pays 45%. Their rent is $4,800 and their

heat/fuel is $400. Bob should list $2,640 on line 9 and $220 on line 10. Joe will list $2,160 on line 9 and $180 on line 10.

Nursing Home Residents: Persons living in nursing homes or assisted living centers are NOT eligible for the PTC

Rebate unless one of the following applies:

• The applicant was in assisted living for only part of the year, and

• Before they moved into assisted living they paid rent and/or heat/fuel. In this case, the rebate is based on

20% of the expenses and 100% of the total income received;

or

• They paid 2015 property taxes while residing in assisted living during 2016. In this case, they may report

the full amount of property tax paid.

or

• Only one spouse within a married couple resides in a nursing home/assisted living center. The spouse who

maintains the home may file as a single person to report his/her income and expenses only.

Deceased Persons: Surviving spouses or legal representatives may file a PTC application on behalf of a deceased

person. Complete the application as usual. You must mark the box next to the name of the deceased person, and write

“D

” in large letters in the white space above the tax year of the return, write “F

s

s

” or “F

eceaseD

iling as

urviving

pouse

iling

l

r

” after your signature, and attach form DR 0102 and a copy of the death certificate to the return.

as

egal

epresentative

Rebate Status

You must allow a minimum of 12 weeks to process your application. To check the status of your PTC rebate, follow

these easy steps:

1. Visit

2. Click the Request a Letter ID hyperlink in the Additional Services section. Fill in the requested information.

You will receive the Letter ID by mail in about 2 weeks.

3. After you receive the Letter ID, return to

4. Click Where’s My Refund in the Quick Links section.

5. Click the down-arrow next to Account Type and select Property Tax/Rent/Heat Rebate.

6. SSN is the default setting or you can click the down arrow to select ITIN.

7. Enter your SSN or ITIN.

8. Enter your Letter ID, then click OK.

DO NOT call to check your status before April 18, 2017. Please note that the phone wait times can be very long, so we

recommend that you use the Internet instead. The refund status on the Internet provides the most current information

available.

Federal Credit and Colorado Insurance Programs

Individuals whose income does not exceed certain thresholds and/or have qualifying children may be eligible for a

refund resulting from the federal Earned Income Tax Credit (EITC) and/or low-cost health insurance through Child

Health Plan Plus (CHP+). You may obtain additional information regarding the EITC online at or by

calling Colorado United Way at 211. Additional information regarding CHP+ can be found online at or

by calling 1-800-359-1991.

Apply Online

You can file this application online instead of mailing it. Visit and simply answer

the questions to help guide you through the application process. Using the online application will help prevent errors

or incomplete information, which might otherwise delay your rebate. You must supply an email address to file online.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12