Instructions for completing Form W-4VT

Who must complete Form W-4VT:

• Any person whose employer requires this form

•

Any person requiring Vermont Withholding to be based on W-4 information which is different from the

Federal W-4. This would include employees anticipating Child Tax Credit, Hope Credit, or other federal

credits which do not pass through to Vermont income tax and employees who are in civil unions.

Completing Form W-4VT: This form is completed in the same manner as the Federal W-4. Complete the federal W-

4 form first, following the instructions on the form or IRS Publication 919, How Do I Adjust My Tax

Withholding?.

Print or type your Name and Social Security Number. For taxpayers using the fillable

Parts 1 and 2:

PDF, type in the Social Security Number without hyphens.

Part 3:

Enter any information required by your employer.

Part 4: a.

If you are a partner in a civil union, check either “Civil Union” or Civil Union, but

withhold at the higher Single rate”. Otherwise check the filing status used on the Federal

b.

Enter the number of allowances for Vermont withholding. If you claimed additional

allowances for Federal tax because of anticipated child credit or education credit, do not

claim these additional allowances for Vermont withholding.

If you want an additional amount of Vermont withholding to be deducted from each

c.

paycheck, enter amount.

d.

Claiming exempt from withholding means that no State income tax will be

withheld from your wages. Write 'Exempt' in the box below only if you meet both

of the requirements.

Part 5: Sign and date the form. Send completed forms to Payroll Division either by fax to 828-2435;

email to: VISION-Payroll@state.vt.us;

or mail to VTHR Operations, Payroll, 120 State Street, Montpelier VT 05620-2504

This form may be photocopied as needed.

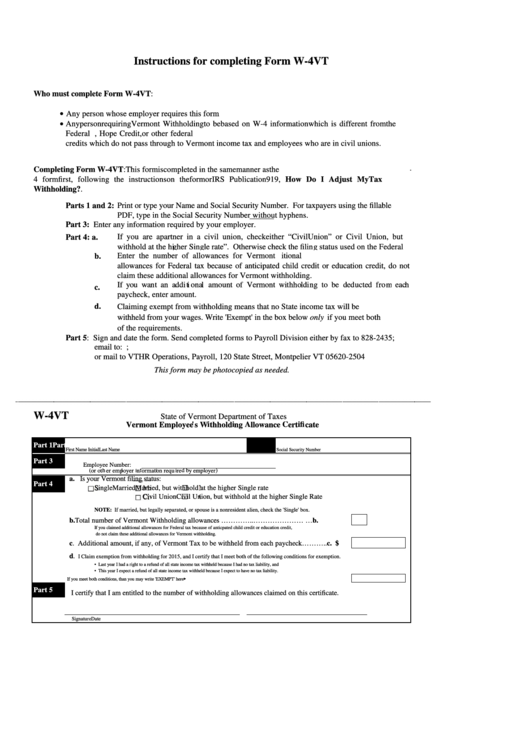

W-4VT

State of Vermont Department of Taxes

Vermont Employee's Withholding Allowance Certificate

Part 1

Part 2

First Name

Initial

Last Name

Social Security Number

Part 3

Employee Number:

(or other employer information required by employer)

a. Is your Vermont filing status:

Part 4

Single

Married

Married, but withhold at the higher Single rate

Civil Union

Civil Union, but withhold at the higher Single Rate

NOTE: If married, but legally separated, or spouse is a nonresident alien, check the 'Single' box.

b. Total number of Vermont Withholding allowances …………..………………….......…b.

If you claimed additional allowances for Federal tax because of anticpated child credit or education credit,

do not claim these additional allowances for Vermont withholding.

c. Additional amount, if any, of Vermont Tax to be withheld from each paycheck………..c.

$

d.

I Claim exemption from withholding for 2015, and I certify that I meet both of the following conditions for exemption.

• Last year I had a right to a refund of all state income tax withheld because I had no tax liability, and

• This year I expect a refund of all state income tax withheld because I expect to have no tax liability.

If you meet both conditions, than you may write 'EXEMPT' here............................................▶

Part 5

I certify that I am entitled to the number of withholding allowances claimed on this certificate.

Signature

Date

1

1